How to Invest Like Warren Buffett — 10 Tips

Warren Buffett, also known as the Oracle of Omaha, is one of the most successful investors of all time. He is the chairman and largest shareholder of Berkshire Hathaway (NYSE:BRK.B), a multinational conglomerate holding company. Buffett is known for his long-term, value-oriented approach and his ability to identify undervalued companies with strong fundamentals. Via Berkshire stock, Buffett has achieved a 186% return over the past 10 years and a 1,365% return since May of 1996.

Therefore, here are some key principles of his investment strategy that you can consider when building your own investment portfolio:

#1) Invest in companies with strong competitive advantages

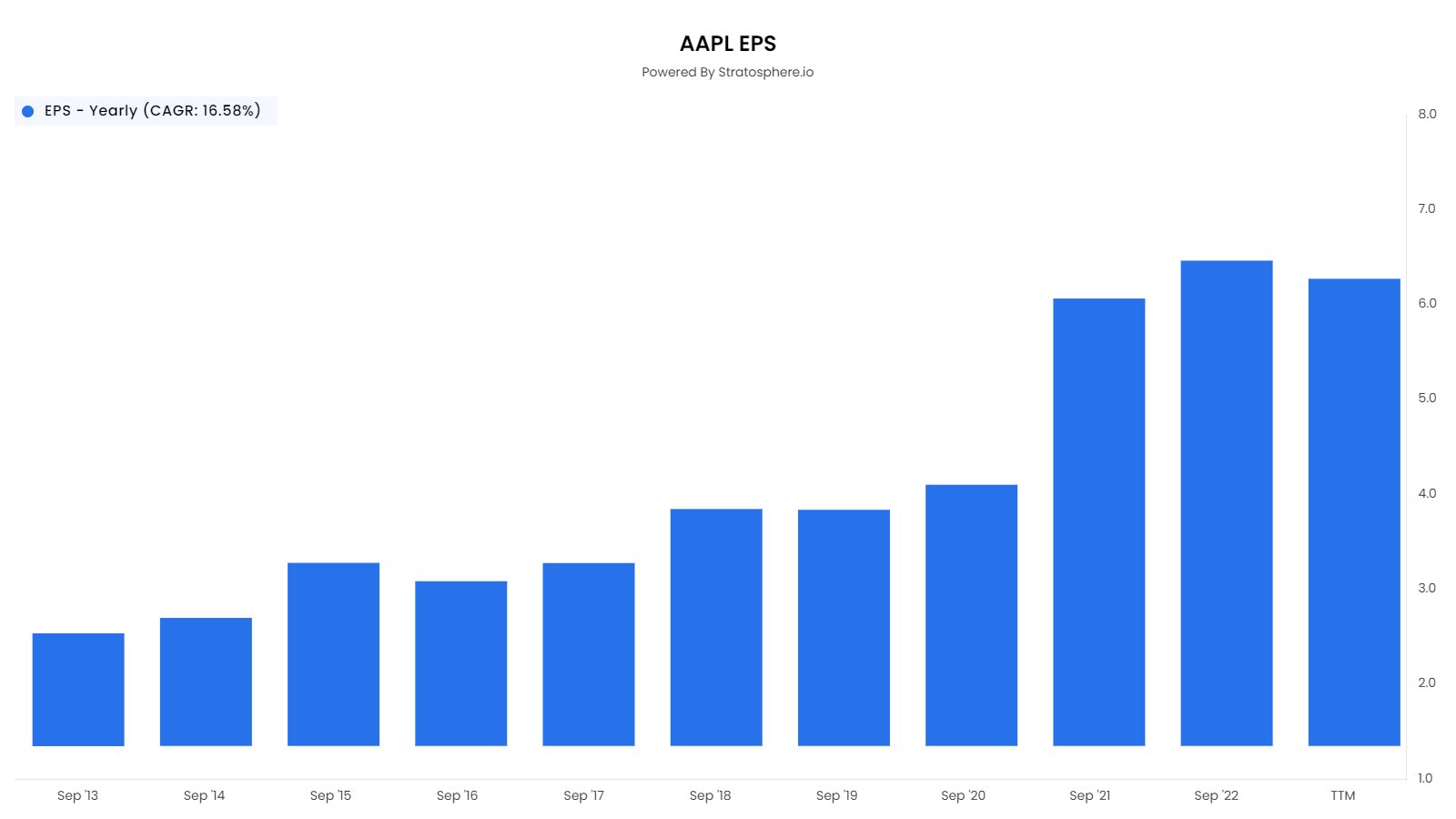

Buffett looks for companies that have a sustainable competitive advantage (known as a “moat”), such as a strong brand, a large market share, or a proprietary technology. These companies are often able to generate consistent profits and maintain their competitive position over time. For example, Apple, which is Buffett’s biggest holding, is known to have a moat (its strong brand power and its product ecosystem). As a result, it has been able to grow its earnings pretty steadily over the past 10 years. See its earnings below.

source: stratosphere.io

#2) Buy companies at a discount to their intrinsic value

Buffett looks for companies that are undervalued by the market and are trading at a discount to their intrinsic value. These stocks are referred to as having a “margin of safety” in the investing world because they provide a cushion against potential downside risk. This is important because it means that even if the company's performance falls short of expectations, the investment can still be profitable due to its low valuation.

He calculates the intrinsic value of a company by analyzing its financial statements, industry trends, and future growth prospects. He then compares this value to the company's current stock price to determine if it is undervalued.

A popular and easy-to-use site to find intrinsic value estimates is simplywall.st (14-day free trial and 30% off using this special link). Below is an example of a fair value estimate from simplywall.st on Meta Platforms (NASDAQ:META) stock. On the site, you can even click on “data” (in the bottom right of the screenshot below), and it would show you exactly how the platform arrived at the valuation.

source: simplywall.st

#3) Focus on the long-term

Buffett is known for his long-term investment approach. He believes that the stock market is inherently volatile in the short term, but over the long term, the underlying value of a company will eventually be reflected in its stock price. By focusing on the long term, he is able to ignore short-term market fluctuations and make investment decisions based on the company's fundamentals.

#4) Keep your portfolio concentrated:

Buffett has often expressed his thoughts on diversification. In his annual letters to shareholders of his company Berkshire Hathaway, he has repeatedly emphasized the importance of concentration in investing. He believes that investors should focus on a few high-quality companies and hold them for the long term, rather than diversifying their portfolio across many different companies.

Buffett has famously said, "Diversification is protection against ignorance. It makes little sense if you know what you are doing." He has also referred to diversification as a "hedge for the ignorant" and has criticized the concept of spreading investments across a large number of stocks or mutual funds. In his view, excessive diversification can lead to mediocre returns and dilute the benefits of owning a few exceptional companies.

However, Buffett also acknowledges that diversification can be important for some investors who are not comfortable with concentrated positions or who lack the knowledge or expertise to analyze individual companies.

Nonetheless, below is Buffett’s portfolio as of the end of 2022. As you can see, Apple's (NASDAQ:AAPL) stock makes up more than 1/3 of the portfolio.

source: https://www.buffett.online/en/portfolio/

#5) Avoid trendy stocks or fads

Buffett avoids trendy stocks or fads because they are often overpriced and lack a sustainable competitive advantage. He believes that these types of investments are often driven by speculation and hype rather than fundamentals. A good example would be meme stocks such as GameStop and AMC, which rose substantially in early 2021, only to fall heavily after the hype faded away (especially AMC, see below).

#6) Stay within your circle of competence

Warren Buffett advises investors to stay within their circle of competence and invest in companies and industries that they understand. He believes that investors should focus on what they know and avoid investing in companies or industries that they are not familiar with.

#7) Be Patient

Buffett is known for his patience when investing. He is willing to wait for the right opportunity to come along rather than rushing into an investment. He believes that this approach allows him to make more informed decisions and invest in companies that are truly undervalued.

#8) Have the willingness to hold on to your investments

Buffett is generally known for holding on to his investments for a long period of time. He believes that this allows him to ride out any short-term volatility in the stock market and allows the underlying value of the company to be reflected in its stock price over time. However, this isn’t set in stone. He sometimes makes quicker investments, such as when he bought Taiwan Semiconductor (NYSE:TSM) stock in Q3 2022 but sold it just one quarter later.

#9) Stay Informed

Buffett reads extensively and stays informed about the companies he is interested in investing in. He believes that by staying informed about the companies and industries he is invested in, he is better able to identify potential investment opportunities and make more informed investment decisions.

#10) Learn from your mistakes

Finally, Warren Buffett advises investors to learn from their mistakes and to continually improve their investing skills. He acknowledges that not every investment will be successful, but he believes that investors can learn from their failures and improve their investing strategies over time.

Conclusion

In summary, investing successfully like Warren Buffett requires a long-term perspective, a focus on high-quality companies, a disciplined and patient approach, and extensive research and due diligence. By following these principles, investors can increase their chances of generating consistent returns over time and building wealth for the long-term.

Recommended Tool for Investors — Simplywall.st

Simply Wall St helps retail investors build successful stock portfolios with their platform, where you can research and analyze the companies you love. Access highly-useful stock screeners and easily analyze a company’s balance sheet health, insider trades, analyst forecasts, valuation metrics, and more.

Simply Wall St is free to use forever, but if you want a 14-day free trial and a 30% discount, then you can sign up through our link by clicking here.