Apple (NASDAQ:AAPL) Unveils iPhone 16. Should You Buy AAPL Stock?

Apple unveiled the highly anticipated iPhone 16 series today, September 9, 2024, showcasing some advancements across the new iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max models. The standout feature across the Pro models is the powerful A18 Pro chip, which delivers a boost in performance, energy efficiency, and graphics capabilities, particularly for immersive gaming and video recording in 4K120 fps with Dolby Vision. AAPL stock finished the day mostly unchanged following the news. After reporting the news in this article, we’ll provide a quick reverse DCF valuation to help you determine if it’s a buy or not.

The iPhone 16 Pro and Pro Max introduce a new 48MP Ultra Wide camera, a 5x Telephoto lens, and the debut of the "Camera Control" button, which allows users to seamlessly interact with the camera system. This new button, made from sapphire crystal, lets users adjust zoom, depth of field, and more with just a touch. Apple also touted the improved battery life, with the iPhone 16 Pro Max offering the best battery performance ever in an iPhone.

The iPhone 16 and 16 Plus models boast improved heat dissipation, a new thermal design, and a 30% higher sustained performance for graphics. These models feature an upgraded 48MP Fusion camera and introduce new colors, including Ultra Marine, Teal, and Pink. Another key highlight is the integration of Apple Intelligence, an AI-powered feature designed to help users manage tasks, generate language-based content, and enhance their overall digital experience.

All models will be available for pre-order starting September 13, with general availability beginning on September 20, 2024.

Let’s Take a Look at AAPL Stock’s Valuation

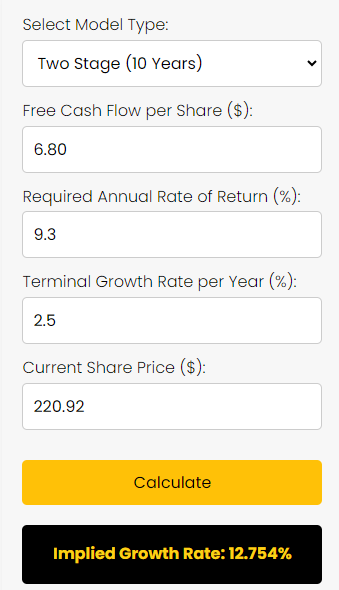

Let’s do some calculations to help you determine if Apple stock is a buy or not based on the market’s expected growth for the firm. Here are the inputs:

TTM FCF per share of $6.80

Discount rate (cost of equity) of 9.3%

Terminal growth rate of 2.5%

Current share price of $220.92

Using our reverse DCF calculator, the market is pricing AAPL to grow its free cash flow per share by 12.754% annually for the next 10 years and then by 2.5% every year after that. See the image below.

Essentially, if you think AAPL can surpass this growth rate, then it's underpriced, and vice versa.

Thanks for reading! If you’d like to learn more about our Reverse DCF calculator, check out the article below.