Fortinet Stock (NASDAQ:FTNT) Falls Despite Beating Q1 Earnings

Fortinet just announced its Q1-2024 earnings results, which beat both earnings and revenue expectations. Nonetheless, the stock is down in after-hours trading. Here are the numbers:

Non-GAAP EPS of $0.43 vs. $0.38 expected. Last year’s Q1 EPS was $0.34.

Revenue of $1.35 billion vs. $1.34 billion expected — up 7%. Last year’s Q1 revenue was $1.26 billion.

Cash flow from operations increased to $830 million, up from $677.5 million in the prior year.

Free cash flow fell from $647.2 million to $609 million.

GAAP operating margin of 23.7%

Non-GAAP operating margin of 28.5%.

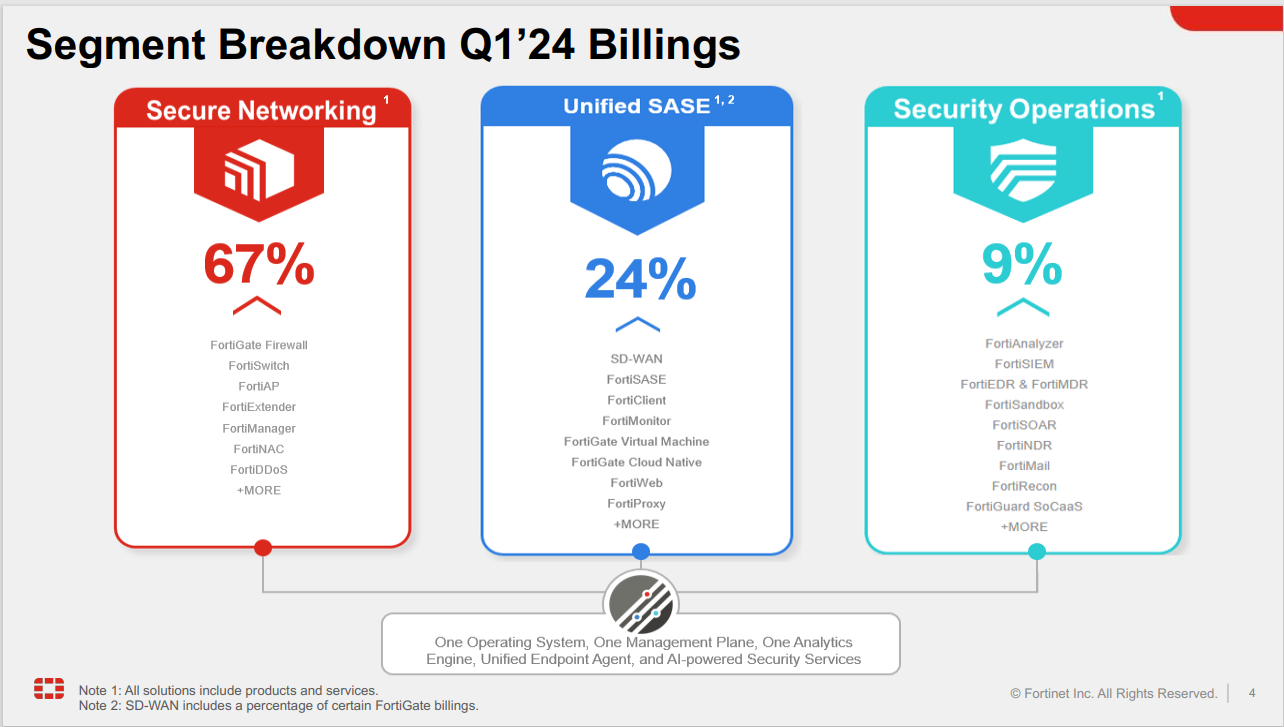

And below is a breakdown of FTNT’s Q1-2024 billings.

Fortinet Reports Strong Q1 2024 with Continued Growth in Service Revenue

In a display of robust financial health, Fortinet, a leader in global cybersecurity solutions, reported a promising start to 2024. The company's latest earnings release highlighted significant gains, particularly in its service sector, despite a broader challenging economic landscape.

Fortinet's total revenue for the first quarter reached $1.35 billion, marking a 7% increase from the previous year's figure of $1.26 billion. This growth was spearheaded by a substantial 24% increase in service revenue, which totaled $944 million, up from $761.6 million in Q1 2023.

However, it wasn't all upward trends; the company saw a decline in product revenue, which fell by 18.3% to $408.9 million, down from $500.7 million the previous year. This shift reflects a changing focus within the company’s revenue streams, highlighting an increasing reliance on service-based income.

Cash flow from operations was a strong point, with an increase to $830 million, up from $677.5 million in the prior year. Free cash flow, though slightly lower than last year at $609 million, remained robust, supporting the company's strategic initiatives.

Fortinet’s figures demonstrate the company’s ability to maintain profitability while investing in growth and innovation.

Strategic Highlights and Market Positioning

Ken Xie, Founder, Chairman, and CEO, emphasized Fortinet's strategic advancements in his statement. The company has focused on expanding its Unified SASE and Security Operations, aiming to capitalize on the growing demand in these sectors. Fortinet’s comprehensive approach to merging networking and security through its FortiOS operating system and AI innovations positions it uniquely in the market.

Looking Ahead: Q2 and Full-Year Projections

Looking forward, Fortinet has set optimistic goals for Q2 and the rest of 2024. For the upcoming quarter, they expect revenue between $1.375 billion and $1.435 billion and billings ranging from $1.490 billion to $1.550 billion. For the full year, forecasts include revenue between $5.745 billion and $5.845 billion and billings from $6.400 billion to $6.600 billion. Lastly, FTNT expects diluted non-GAAP EPS between $1.73 and $1.79. This assumes a 780-790M diluted share count.

Thanks for reading. If you’re looking for a trustworthy site for fundamental analysis, consider using Finbox. Finbox provides access to essential fundamental data, along with advanced stock screeners, investment ideas, valuations, and much more.