How to Calculate Weighted Average Cost of Capital (WACC)

Businesses require capital to operate and grow, and they secure this capital through a combination of debt and equity. Each financing method has associated costs: debt incurs interest payments, while equity entails an opportunity cost—the returns that investors expect from their investment. The Weighted Average Cost of Capital (WACC) is a crucial financial measure that averages these costs, weighted according to each source's contribution to the overall capital structure. This article will teach you how to calculate it step by step, and we’ll also link to a tool that can calculate it for you.

Why Weighted Average Cost of Capital (WACC) Is Important

The Weighted Average Cost of Capital (WACC) is important, especially when it comes to valuing stocks (as it serves as the discount rate — required rate of return — for projecting future cash flows) and evaluating the economic viability of capital projects. It effectively quantifies the minimum return a company must generate on its assets to meet the expectations of its creditors and shareholders.

How WACC Can Help You Value a Stock

Understanding WACC is essential for both beginners and intermediate investors because it acts as a foundational concept in the valuation of stocks and businesses. Here's why WACC is indispensable in financial valuation:

It gives you a Discount Rate (required rate of return) for Cash Flows: In valuation models like the Discounted Cash Flow (DCF) analysis (check out our free reverse DCF calculator here), WACC is used as the discount rate to determine the present value of future cash flows. This method helps estimate what a company is worth based on the expected cash flows it will generate, adjusted for the cost of capital. Essentially, using WACC allows investors to calculate how much they should pay today for anticipated future returns.

Benchmark for Investment Decisions: WACC serves as a benchmark against which the profitability of potential investment opportunities can be assessed. If a project’s return exceeds the WACC, it typically indicates that the project is expected to generate sufficient returns to justify the risk associated with the investment. Conversely, if a project’s return is below the WACC, it might be deemed too risky or unprofitable, suggesting that the invested capital might be better utilized elsewhere.

Assessment of Risk and Cost Structure: WACC provides insight into how a company’s risk level and its capital structure—how it finances its operations through debt and equity—affect its overall valuation. A higher WACC indicates higher risk and/or higher costs of financing, which can affect a company's stock price and market perception.

How to Calculate WACC

Calculating the Weighted Average Cost of Capital (WACC) involves a methodical approach that integrates the costs associated with each type of capital—debt and equity. Below is a step-by-step guide to help you compute WACC, using practical examples for clarity.

Step 1: Calculate the Cost of Debt

Cost of Debt is the effective rate that a company pays on its total debt. To calculate it:

Find the total debt: This should include all forms of debt, such as bonds, loans, and other borrowings like capital leases, if they are material.

Determine the interest expense: This is the annual interest payable on the debt.

Compute the pre-tax cost of debt: Divide the annual interest expense by the total debt.

Pre-tax Cost of Debt=Interest ExpenseTotal DebtPre-tax Cost of Debt=Total DebtInterest Expense

Calculate the after-tax cost of debt: Interest expenses are tax-deductible, so the after-tax cost is less than the pre-tax cost. Multiply the pre-tax cost of debt by 1−Tax Rate

After-tax Cost of Debt = Pre-tax Cost of Debt × (1−Tax Rate)

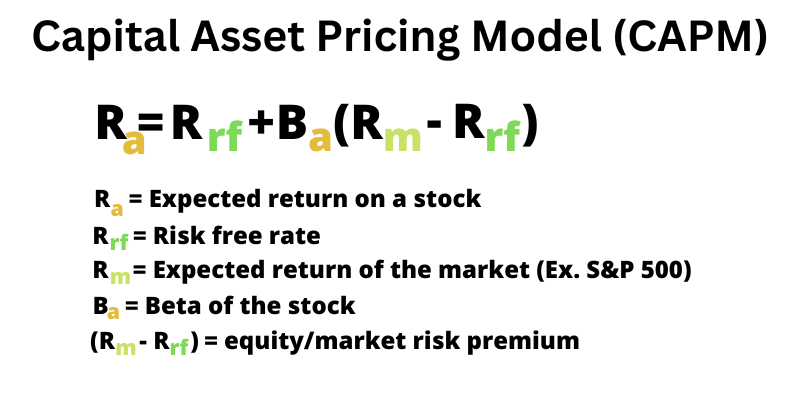

Step 2: Calculate the Cost of Equity Using the Capital Asset Pricing Model (CAPM)

Cost of Equity reflects the compensation the market requires to own the equity of a company and bear the risk of ownership.

Determine the risk-free rate: Typically, this is the yield on long-term government bonds.

Find the beta of the stock: Beta measures the volatility or systematic risk of a security in comparison to the market as a whole.

Estimate the market risk premium: This is the return expected from the market above the risk-free rate.

Use the Capital Asset Pricing Model (CAPM) to calculate the cost of equity:

Step 3: Determine the Capital Structure

To find the WACC, you must know the proportion of debt and equity in the company’s capital structure.

Calculate the market value of equity (Equity Value): Typically, this is the current stock price multiplied by the total number of outstanding shares.

Find the market value of debt: This should be the book value if the market value isn’t readily available.

Compute the total value of the firm: Add the market value of debt to the market value of equity.

Determine the weight of debt and equity: Divide the market value of each component by the total value of the firm.

Weight of Debt = Market Value of Debt/Total Value of Firm

Weight of Equity = Market Value of Equity/Total Value of Firm

Step 4: Compute WACC

Finally, calculate WACC by multiplying the cost of each component by its respective weight, and then sum these results.

WACC = (Weight of Equity×Cost of Equity) + (Weight of Debt×After-tax Cost of Debt)

Example: Calculating Nvidia’s WACC

Step 1: Calculating the Cost of Debt for Nvidia (NASDAQ:NVDA)

To calculate the cost of debt:

Total Debt (including capital leases): $11.056 billion

Interest Expense: $257 million

Calculate the pre-tax cost of debt by dividing the interest expense by the total debt:

Pre-tax Cost of Debt = 257,000,000/11,056,000,000 = 2.33%

Assuming a corporate tax rate of 21%, calculate the after-tax cost of debt, which reflects the tax savings due to interest deductibility: After-tax Cost of Debt = 2.33% × (1−0.21) = 1.84%

Step 2: Calculating the Cost of Equity for Nvidia

Using the Capital Asset Pricing Model (CAPM):

Beta (β): 1.74

Risk-Free Rate: 4.52% (current US 10-year yield)

Expected Market Return: 10% (we used 10% because the market returns roughly 10% per year on average over the long term).

Calculate the cost of equity: Ra = 4.52%+1.74×(10%−4.52%) = 13.52%

Step 3: Determining the Proportional Weights of Debt and Equity

Calculate the proportionate weights of debt and equity in Nvidia’s capital structure:

Market Cap: $2.1445 trillion

Total Debt (including capital leases): $11.056 billion

Step 4: Calculating Nvidia's WACC

Combine the weights and costs to compute the WACC:

Nvidia’s WACC = (0.51%×1.84%) + (99.49%×13.52%) = 13.44%

How Market Return Assumptions (Discount Rates) Affect WACC

To illustrate the sensitivity of WACC to changes in the expected market return, let’s recalculate Nvidia’s cost of equity using a 9% market return instead of 10%:

Ra = 4.52%+1.74×(9%−4.52%) = 12.81%

Re-calculating the WACC with this new cost of equity: WACC = (0.51%×1.84%)+(99.49%×12.81%) = 12.75%

Reducing the expected market return from 10% to 9% decreases Nvidia's WACC from 13.44% to 12.75%. This variation underscores the importance of the assumptions made regarding market returns in WACC calculations.

Conclusion: The Importance of WACC in Investing

For investors, understanding WACC is key to making informed decisions. It helps them evaluate whether a company is managing its debt and equity efficiently to generate value. A company with a lower WACC is generally seen as less risky, as it needs to earn less from its investment activities to satisfy its stakeholders. On the other hand, a high WACC suggests a higher risk profile, which could indicate that the company needs to reassess its use of debt or its operational strategies to optimize its financial structure.

In the broader scope of investment analysis, knowing how to calculate and interpret WACC not only aids in stock valuation but also in strategic financial planning and corporate finance management. It enables investors to gauge the efficiency of a company's financial management and its potential for future growth and profitability.

The example of Nvidia illustrates how sensitive WACC is to changes in market return assumptions, highlighting the importance of accurate financial forecasting. A slight adjustment in expected market returns can significantly alter WACC, impacting strategic decisions and the stock’s perceived “fair value.”

Too Much Work to Manually Calculate WACC? Use This Tool

If you're looking to streamline your WACC calculations or overall fundamental analysis, consider using Finbox. Finbox provides access to essential fundamental data, along with advanced stock screeners, investment ideas, valuations, and much more.