Nvidia Stock (NASDAQ:NVDA): Not Quite Overvalued. Here’s Why

Nvidia (NASDAQ:NVDA) has gained nearly 2,000% in the past 5 years and has made significant strides in the tech industry, recently with the launch of its H100 and Blackwell GPUs. This innovation, highlighted at the GTC 2024 event, has set Nvidia apart, and analysts have noticed. Financially, Nvidia’s performance is nothing short of stellar, with recent quarterly earnings far surpassing expectations and projections indicating continued growth. However, this rapid rise questions about its valuation. Using a reverse DCF calculator below, we see the market’s growth expectations embedded in Nvidia's current stock price, which will help you decide if the stock is overvalued or not. Overall, the valuation doesn’t look too outrageous.

Let’s take a deeper look.

Source: TradingView

A Tech and Financial Powerhouse

The introduction of Nvidia's new chips, the H100 and the even more advanced Blackwell GPUs, marks a significant leap in AI processing power. These chips are designed to handle massive computations faster than anything else out there, making them a golden ticket for anyone diving deep into AI.

Nvidia has been making strategic maneuvers and showcasing financial muscle, particularly highlighted during the GTC 2024 event. UBS analyst Timothy Arcuri, a highly rated analyst, observed that Nvidia's unveiling of the "Blackwell" artificial intelligence chip at GTC positions it on the brink of an unprecedented demand wave from global enterprises and sovereigns.

This notion introduces a fascinating angle: Nvidia isn't merely responding to market demand but is strategically creating its own market, according to the analyst. By selling pre-packaged AI models alongside the necessary chips to run them, Nvidia seems to be orchestrating its own demand, a masterstroke in market creation.

On the financial side, Nvidia has been posting numbers that are hard to ignore. Their recent quarterly earnings reported a staggering 265.3% year-over-year increase in revenues to $22.1 billion, surpassing estimates by $1.55 billion. Non-GAAP EPS of $5.16 also beat expectations by $0.52. It's not every day you see a big company more than triple its top line.

The financial implications of Nvidia's strategy, as per Arcuri's analysis, are staggering. From a revenue standpoint, Nvidia's leap from just under $61 billion in 2023 to a projected $112.5 billion this year, with net profit margins astonishingly jumping to 57%, paints a picture of a company on an explosive growth trajectory. Even more, Arcuri suggests a climb to $146.9 billion in revenues by 2025, with profits soaring to $84.8 billion. However, he does inject a note of caution regarding the sustainability of such growth and margins, anticipating a normalization in the longer term.

Growth Beyond the Horizon

Nvidia's stock has seen a monumental rise, but the underlying technology and market demand suggest there's still potential for growth. Their foray into robotics and the unveiling of Project GR00T underscore their commitment to innovation. However, the rapid stock appreciation has raised eyebrows, drawing parallels to the dot-com bubble era and sparking debates about overvaluation.

Despite such concerns, Nvidia's dominance in the AI chip market is undisputed. With a focus on data centers, where demand for AI capabilities is exploding, Nvidia's chips have become virtually irreplaceable. This market dominance is reflected in their financials, where GAAP operating income soared to $32,972 million in fiscal 2024, marking an incredible 681% increase from the previous year.

The Data Center segment, responsible for a whopping 217% year-over-year growth on a full-year basis, is at the heart of Nvidia's success story. This segment alone grew from $15,005 million in fiscal 2023 to $47,525 million in fiscal 2024, emphasizing the surging demand for Nvidia's AI chips.

Potential Pitfalls

The path forward is not without its challenges. The volatile nature of the tech industry, geopolitical tensions, and the potential for market corrections loom as significant risks. Nvidia's continued success hinges on its ability to maintain its innovation lead, manage market expectations, and navigate these potential hurdles. The higher its price goes, the higher the expectations.

Speaking of Its valuation, let’s do the math and see what growth the market is currently expecting from NVDA based on its valuation.

NVDA Stock’s Valuation

To determine if NVDA is overvalued, you can use our reverse DCF calculator. This essentially tells you how much growth the market is expecting based on the stock’s current price. You then decide if that growth is realistic when determining if the stock is too pricey or not.

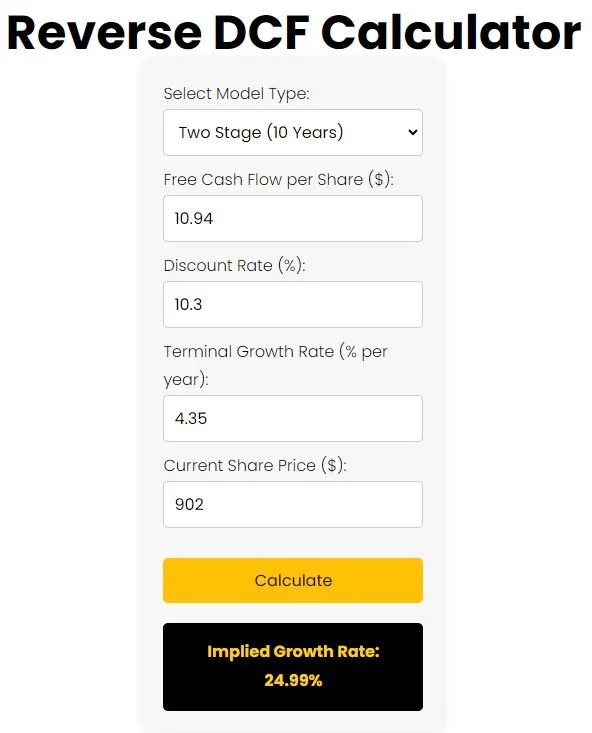

As you can see below, based on its recent share price of $902, the market is implying that it can grow its free cash flow by 24.99% per year for the next 10 years (followed by 4.35% growth every year after that). The discount rate (also known as the required rate of return) of 10.3% was taken from Finbox. We used NVDA’s weighted average cost of capital (WACC) for the discount rate. The terminal growth rate used was the 30-year US treasury yield. See below.

Put into simpler terms: if you buy at $902 and NVDA achieves 24.99% free cash flow growth for the next 10 years and 4.35% growth per year after that (perpetually), you can expect to make 10.3% returns per year. If you think NVDA will outperform those growth expectations, then you can make more than 10.3%, and vice versa.

With that in mind, let’s look at the EPS and FCF growth rates that analysts expect.

How Much Growth Are Analysts Expecting from NVDA?

There’s no doubt that analysts expect high growth. But just how much?

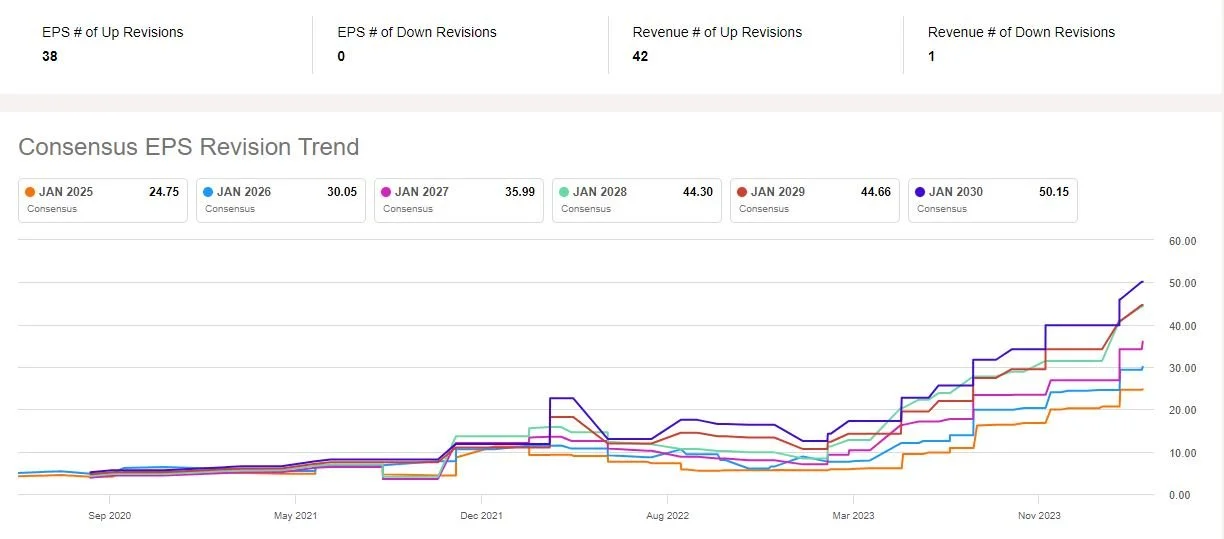

Expected EPS growth: As you can see below for Fiscal 2025, 2026, and 2027, NVDA’s EPS is expected to grow by 91%, 21.4% and 19.77%, respectively. After that, the number of analysts making projections comes down considerably, so the numbers are less reliable. But overall, analysts expect double-digit growth. By Fiscal 2027, its forward P/E comes down to 25x.

Source: Seeking Alpha

Expected free cash flow growth: Looking at its forecasted free cash flow growth, NVDA is expected to grow its FCF by 36.8% per year for the next five years, according to Finbox — not bad at all. When looking at it through this lense, it’s possible that NVDA’s high valuation is justified.

Earnings Keep Getting Revised Upward

The thing that has kept NVDA stock rising has been its ability to blow past expectations, causing analysts to constantly revise their estimates higher. For instance, just 1 year ago, January 2025 earnings per share were expected to come in at $5.86. Now, January 2025 EPS forecasts have been revised to $24.60. That’s a HUGE jump. This is both a good thing and a bad thing.

The good thing is that this trend can continue, and NVDA can keep blowing past estimates, which will drive the stock higher. The bad thing is that if NVDA ends up missing estimates and earnings expectations get revised lower, the stock can crash big, as investors have been spoiled by NVDA lately. See the past EPS revisions below.

Source: Seeking Alpha

Conclusion: NVDA Stock Doesn’t Look Too Pricey

Nvidia stands at a pivotal point, balancing its innovation and power against the backdrop of its current valuation. The company’s has a bright future, driven by its ability to not just respond to but actively create market demand. However, the optimism reflected in its stock price brings forth challenges, including maintaining high growth rates and managing market expectations.

If NVDA can grow its FCF per share by 25% per year for the next 10 years and maintain low single-digit growth after that, it’s possible that the stock can return over 10% per year, based on our reverse DCF calculator. Analyst expectations for the next 5 years certainly suggest that high growth is likely. Plus, these estimates can keep getting revised higher.

Overall, NVDA doesn’t seem as overvalued as many people think it is, even after its huge rally recently. But it’s also not super undervalued, unless it blows past expectations. That’s the final analysis.