Reasons to Be Thankful: Stock Market 2023 Edition

As we approach the end of 2023, it's a fitting time to reflect on the various aspects of the stock market that have given investors and observers reasons to be thankful. This year has been a testament to the resilience and dynamic nature of the market.

Avoiding a Feared Recession

One of the most significant causes for gratitude is the fact that the feared recession did not materialize. Despite concerns at the start of the year, the U.S. economy has shown remarkable resilience. GDP grew by 4.9% in Q3. This positive outcome can be attributed to a mix of consumer savings from pandemic-era stimulus, fiscal support, and a quick response to the banking crisis, among other factors.

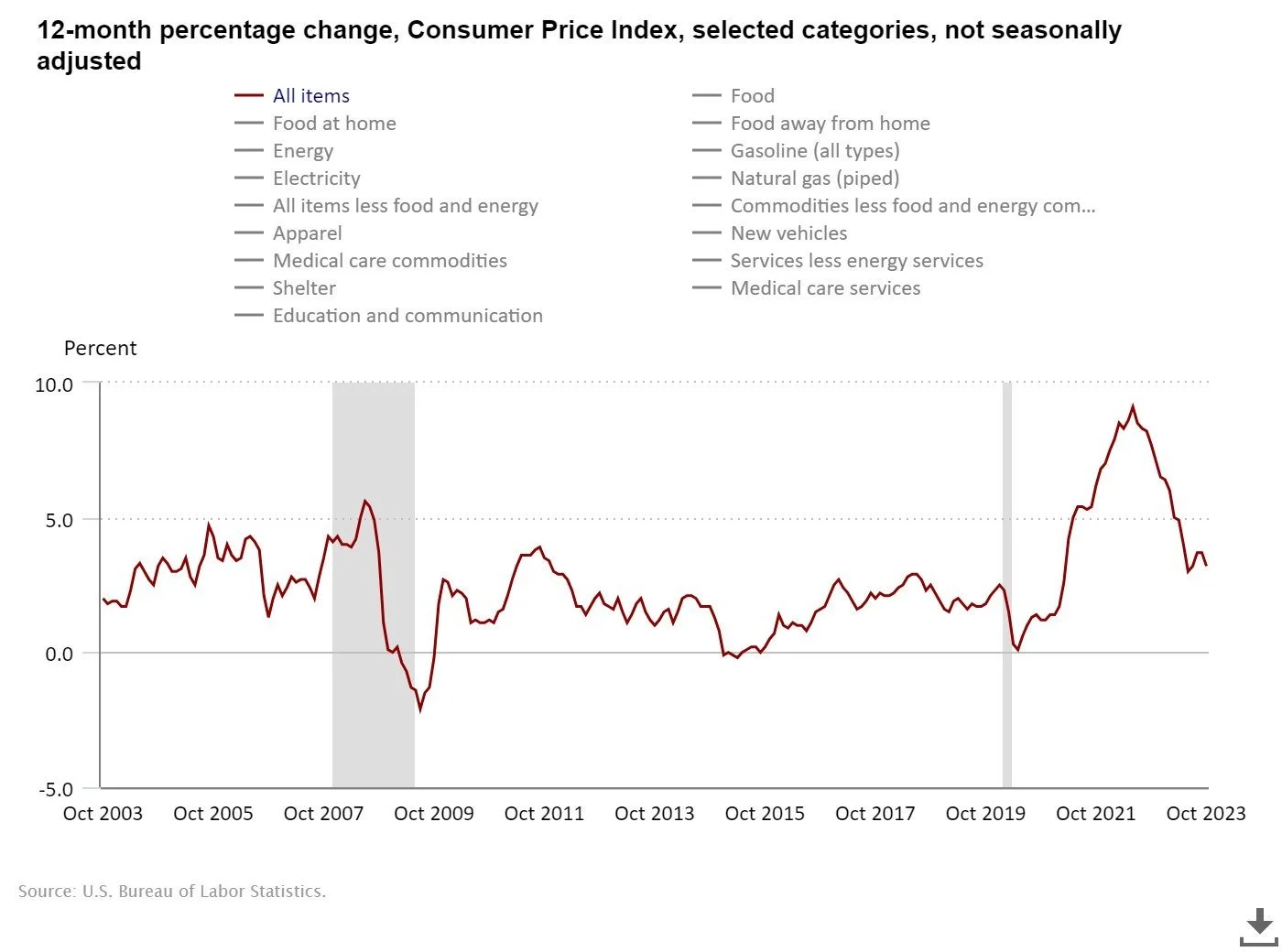

Cooling Inflation

Another thing to be thankful for is the reduction in inflation rates. Inflation came in at 3.2% year-over-year in October. Remember when inflation was near 10%? This cooling trend has brought relief across the board. Lower inflation rates benefit both consumers and investors, signaling more stable economic conditions.

The End of Aggressive Rate Hikes

2023 also marked the end of the aggressive rate hikes by major central banks, including the Fed, ECB, and BoE. This shift in monetary policy has been a welcome change and has spurred speculations of potential rate cuts in the near future, contributing to a more optimistic market outlook.

Below is a chart of the Fed funds rate. As you can see, interest rates have risen dramatically, but this may be the end of the rise. So, let’s be thankful for that.

Source: tradingeconomics.com

Diverse Investment Opportunities

This year's market conditions have opened up a variety of investment opportunities. High bond yields, particularly in municipal and corporate bonds, have offered appealing income potentials. Additionally, the stock market, especially big tech stocks, has shown strong performance. The significant growth in big-tech stocks is something investors can be particularly thankful for. The potential for continued growth in these sectors offers an exciting prospect for the future.

One stock many investors can be thankful for is NVIDIA (NASDAQ:NVDA). Take a look at its performance this year (image below), up 236%.

Source: TradingView

Stability in the Market

The market's stability this year, especially compared to the volatility experienced in 2022, has been a relief. This stability is a testament to the market's adaptability and resilience, providing a sense of security and confidence to investors. Including dividends, the S&P 500 is up 20% year-to-date.

Advancements in AI Technology

The rapid progression in AI technology is another reason for gratitude. The advancements in this field are not only impressive in terms of technological achievement but also offer the potential for boosting capital expenditures and driving future growth in various sectors.

The Value of Dividends

Investors have also been grateful for the consistent and reliable dividends provided by many companies. In a world where financial certainty is highly valued, dividends offer a stable source of income and a cushion against market volatility.

With interest rates currently much higher than historical averages, dividend yields have mostly risen — a great reason to be thankful.

Closing Thoughts

As 2023 comes to a close, it's important to acknowledge these positive developments in the stock market. From avoiding a recession to experiencing growth in key sectors and benefiting from technological advancements, there's much to be thankful for. These factors collectively reinforce the strength and potential of the market, offering hope and optimism as we look towards the future.