Insider Trading in the Stock Market: Necessary Evil or Unfair Advantage?

Insider trading has long stirred up controversy in the investing world. While some people believe it's an unavoidable part of the stock market, others see it as an unfair advantage that jeopardizes the market's integrity. In this article, we'll dive into the different aspects of insider trading, its impact on market efficiency, past insider trading scandals, ethical concerns, and the future of regulation and compliance. We’ll even show you two platforms that show the insider transactions of companies.

Legal Insider Trading vs. Illegal Insider Trading

The term "insider trading" covers both legal and illegal activities. Legal insider trading happens when corporate insiders like officers, directors, and employees buy or sell their company's stock while sticking to securities laws/regulations. These transactions must be reported to the Securities and Exchange Commission (SEC) and are generally viewed as a standard part of the market.

On the other hand, illegal insider trading happens when someone trades based on confidential, non-public information about a company. This type of trading is considered unfair since it gives that person an edge over other investors who don't have access to the same info.

How Insider Trading Impacts Market Efficiency

There's an ongoing argument among market experts about the role of insider trading in market efficiency. Some assert that insider trading contributes to market efficiency by quickly incorporating private information into stock prices. According to this view, insider trading helps markets better reflect a company's true value.

Others argue that insider trading hurts market efficiency by creating information asymmetry. When insiders trade on non-public information, they exploit their privileged position and take advantage of uninformed investors. This can erode trust in the market, discourage wider participation, and ultimately reduce market liquidity while increasing volatility.

Famous Insider Trading Scandals: Lessons Learned

Over the years, several high-profile insider trading scandals have grabbed public attention, highlighting the potential dangers of such activities. Some of the most infamous cases include:

Ivan Boesky: In the 1980s, Boesky, a well-known arbitrageur, was involved in an insider trading scandal that led to significant legal reforms. His case prompted the SEC to ramp up enforcement efforts and tighten regulations around insider trading.

Martha Stewart: The famous businesswoman was convicted of obstruction of justice and lying to investigators in connection with insider trading allegations in 2004. Stewart's case highlighted the need for greater vigilance in monitoring insider trading activities.

These scandals serve as cautionary tales and have pushed regulators to strengthen rules and enforcement to prevent future abuses.

The Ethics of Insider Trading: Balancing Information Asymmetry

The ethical implications of insider trading are closely connected to the concept of information asymmetry. Critics of insider trading argue that it's not ethical because it creates an uneven playing field for market participants, with some having access to privileged information while others don’t. This can lead to a loss of faith in the market and damage its overall integrity.

On the other hand, some people argue that insider trading is an inescapable aspect of the market and that trying to eliminate it entirely would be unrealistic. In this view, regulators should focus on finding a balance between allowing some level of information asymmetry and ensuring that the market remains fair and transparent.

The Future of Insider Trading: Strengthening Regulation, Compliance

The future of insider trading will likely involve more efforts to strengthen regulation and compliance. Advancing tech has made it easier to catch potential insider trading activities, and regulators are increasingly using data analytics and AI to identify patterns and peculiarities.

Additionally, there is a growing emphasis on the importance of corporate culture in discouraging insider trading. Companies are expected to establish clear policies and procedures to prevent and detect insider trading and to promote a culture of ethical behavior and transparency. This includes implementing robust training programs for employees and executives, as well as maintaining strong communication channels to report suspected violations.

Regulators around the world are also working to harmonize their approaches to insider trading in order to better coordinate enforcement efforts and minimize the opportunities for individuals to exploit differences in regulatory regimes. This may involve adopting common standards for defining material non-public information, as well as sharing best practices for investigation and enforcement.

The Takeaway

The role of insider trading in the stock market remains a contentious issue. While some view it as a necessary evil that can contribute to market efficiency, others argue that it represents an unfair advantage that undermines trust in the market. As regulators continue to strengthen rules and enforcement, and companies work to foster a culture of ethical behavior, the hope is that the negative aspects of insider trading can be minimized, ultimately promoting a more transparent and fair market for all participants.

Easy Ways to See Insider Trades

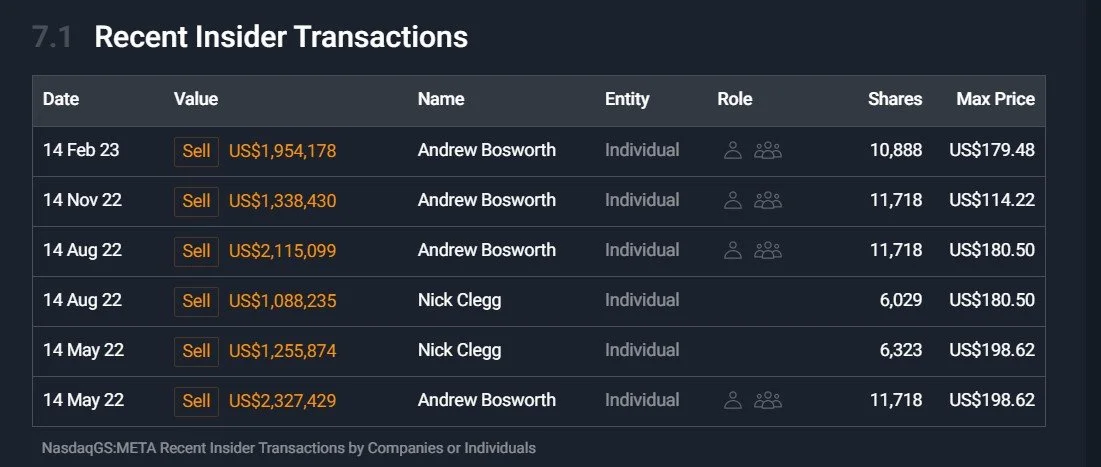

Using simplywall.st or TrendSpider (links provided at the bottom of this article) when analyzing stocks, you can also see insider trades for whichever stock you’re looking at. For example, the two images below from simplywall.st show Meta Platforms’ (NASDAQ:META) recent insider transactions, which were all sells.

Source: simplywall.st

Source: simplywall.st

The next picture below is from TrendSpider, and this one shows Tesla’s (NASDAQ:TSLA) insider transactions. As you can see, these are mostly sell transactions as well.

Source: TrendSpider

Tools to Help You Beat the Market

TrendSpider provides advanced charting software, automated technical analysis, advanced price alerts, backtesting, the ability to create trading bots and trading strategies, insider trading info, advanced stock screeners, and more.

Get 25% off TrendSpider plans by clicking here and using the coupon code SBR25 when signing up.

Simply Wall St helps retail investors build successful stock portfolios with their platform, where you can research and analyze the companies you love. Access highly-useful stock screeners and easily analyze a company’s balance sheet health, insider trades, analyst forecasts, valuation metrics, and more.

Simply Wall St is free to use forever, but if you want a 14-day free trial and a 30% discount, then you can sign up through our link by clicking here.