Why Investing in “Sin Stocks” is Actually Ethical (and Generally Profitable)

Today, let's talk about the infamous "sin stocks" – those naughty little investments that stem from companies in industries like tobacco, alcohol, gambling, and firearms. People often shy away from these stocks due to their controversial nature. Well, let us tell you something - sin stocks might not be as bad as you think. In fact, there's a good chance that adding high-quality sin stocks to your portfolio could make a lot of financial sense. So let's dive right in, shall we?

The Overvalued Stock Paradox: An Unexpected Twist

First off, let's clear up a common misconception: buying sin stocks doesn't mean you're supporting these so-called "evil" companies. When you buy shares on the secondary market, you're not giving these companies any extra dough – you're just trading ownership with other investors.

And here's an interesting twist: the more popular sin stocks get, the more their stock prices might become overvalued. And these companies generally love share buybacks (assuming they’re the big, profitable ones), which is when they buy their own stock to reduce the number of outstanding shares and boost earnings per share. But if the stock price is inflated, these companies end up spending more money to repurchase their shares, making their buybacks less effective. So, in a strange twist of fate, buying sin stocks might actually hinder these companies rather than help them.

The Allure of High-Quality Sin Stocks

Let's face it; sin stocks have a reputation for profitability – and for good reason. Industries like tobacco and alcohol have loyal customers who keep coming back for more, even when times are tough. Add in high profit margins and steady cash flow, and you've got a recipe for a pretty attractive investment.

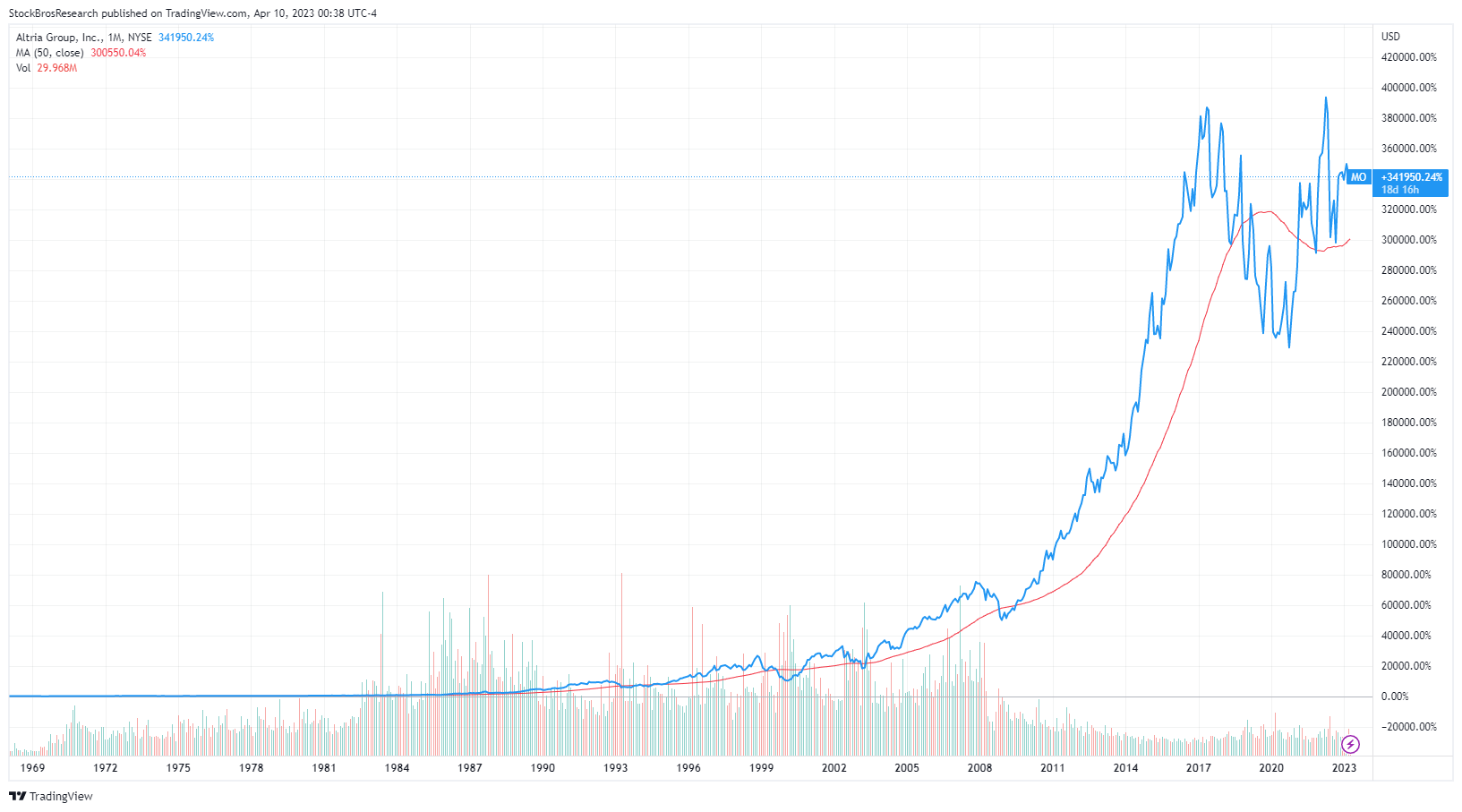

Take Altria stock (NYSE:MO) for example, known for selling cigarettes. It’s one of the best-performing stocks of all time. See the chart below. Altria returned 341,950% return since its IPO, meaning that every $1 invested would have turned into over $340.

MO stock chart. Source: TradingView

Plus, sin stocks can usually weather economic storms. Sure, people might cut back on fancy vacations and designer clothes during a recession, but they're likely to keep indulging in their favorite vices. That means sin stocks can provide stability in your investment portfolio when the going gets rough.

The Moral Dilemma: To Invest or Not to Invest?

Okay, so investing in sin stocks can be a bit of a moral minefield. But here's the thing – investing is a personal decision. Some folks might steer clear of sin stocks for ethical reasons, while others feel they can separate their personal beliefs from their investment strategies.

And don't forget, investing in sin stocks doesn't mean you can't push for positive change. As a shareholder, you can use your voice to advocate for better corporate practices, more responsible decision-making, and increased transparency. So, who knows? Your investment might just help make the world a better place.

Conclusion

So there you have it – sin stocks aren't as clear-cut as they might seem. Sure, they're linked to controversial industries, but buying shares doesn't mean you're endorsing their activities. Plus, high-quality sin stocks can offer some serious financial perks, and even give you the chance to make a difference. At the end of the day, the choice to invest in sin stocks is up to you – just remember to weigh your options and stay true to your values. Happy investing!

Tools to Help You Beat the Market

TrendSpider provides advanced charting software, automated technical analysis, advanced price alerts, backtesting, the ability to create trading bots and trading strategies, insider trading info, advanced stock screeners, and more.

Get 25% off TrendSpider plans by clicking here and using the coupon code SBR25 when signing up.

Simply Wall St helps retail investors build successful stock portfolios with their platform, where you can research and analyze the companies you love. Access highly-useful stock screeners and easily analyze a company’s balance sheet health, insider trades, analyst forecasts, valuation metrics, and more.

Simply Wall St is free to use forever, but if you want a 14-day free trial and a 30% discount, then you can sign up through our link by clicking here.