Nvidia Q2-2025 Pre-Earnings: Here’s What To Expect

As Nvidia prepares to release its Q2-2025 earnings report, all eyes are on how the tech giant will navigate the increasingly competitive landscape. Nvidia has been a standout performer in recent quarters, and investors have become accustomed to this. Here’s what investors should expect in the upcoming report, and we also included a quick valuation on NVDA stock going into earnings:

Expected Revenue for Q2 2025

Analysts expect Nvidia to report total revenues of approximately $28.737 billion for Q2 2025. The expected revenue growth from Q1 2025 to Q2 2025 is approximately 10.4% ($28.7 billion compared to $26.0 billion), and comparing it to Q2-2024 revenue of $13.51 billion, the expected growth rate comes in at over 112%.

Earnings Per Share (EPS) Expectations

Analysts project Nvidia’s adjusted EPS to show strong growth, coming in at $0.645 compared to $0.27 in the previous quarter.

Data Center Segment

Data Center revenues are projected to reach about $25.0 billion in Q2 2025, reflecting continued strong demand for Nvidia's GPUs from cloud service providers.

Guidance and Future Outlook

Nvidia's guidance for Q2 2025 includes expected revenues of $28.0 billion, plus or minus 2%.

GAAP gross margins are anticipated to be around 74.8%, while non-GAAP gross margins are expected to reach approximately 75.5%, with a potential variation of plus or minus 50 basis points.

Analysts are keen to see how Nvidia will guide the market for the rest of FY 2025, especially concerning the Data Center segment and the new Blackwell platform.

Overall, analysts maintain a positive outlook on Nvidia's Q2 2025 earnings, driven by strong performance in the AI and data center markets. However, the company's guidance and performance in other segments will also be closely monitored, of course.

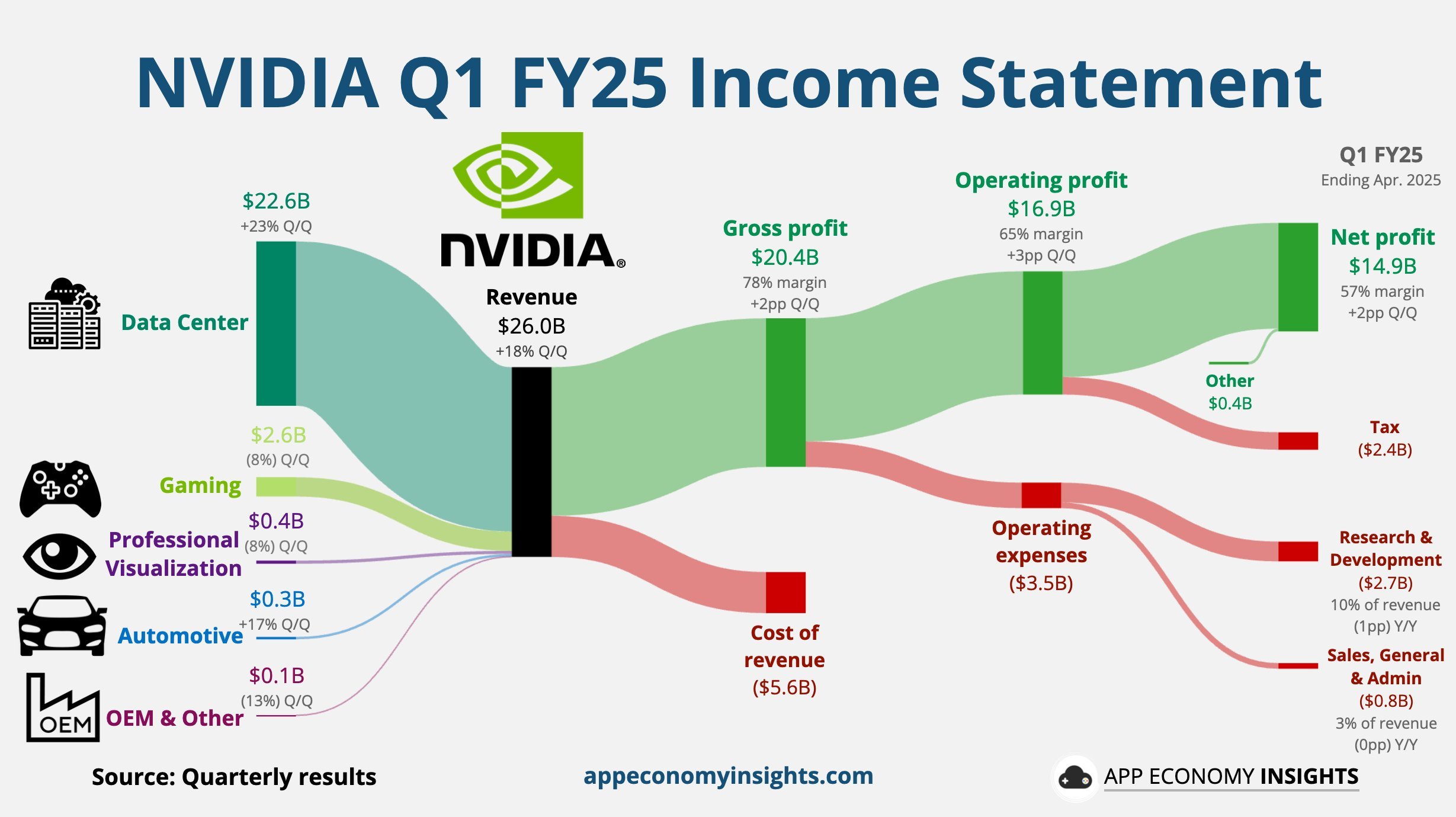

Below, you can check out Nvidia’s income statement from Q1 2025.

Is NVDA Stock Overvalued Going Into Earnings?

Let’s do some calculations to see if Nvidia stock is undervalued. Here are the inputs:

TTM free cash flow per share of $1.60

Discount rate (cost of equity) of 10%

Terminal growth rate of 3%

Current NVDA stock price of $128.30

Using our reverse DCF calculator, the market is pricing NVDA to grow its free cash flow per share by 26.04% annually for the next 10 years and then by 3% every year after that. See the image below.

Essentially, if you think NVDA can surpass this growth rate, then it's underpriced, and vice versa.

Thanks for reading. If you’re looking for a trustworthy site for fundamental analysis, consider using Finbox. Finbox provides access to essential fundamental data, along with advanced stock screeners, investment ideas, valuations, and much more.

Click here to check out Finbox.

And if you’d like to learn more about our Reverse DCF calculator, check out the article below.