What is the Fear and Greed Index? How Can You Profit from It?

The financial markets are a thrilling roller coaster, where the emotions of fear and greed ride high, often dictating investor behavior. Enter the Fear and Greed Index, a brilliant tool that offers a much-needed glimpse into the collective psyche of the market. Created by CNN, the index monitors the pulse of the market, swinging between extreme fear and extreme greed. As an investor, understanding this enigmatic index could be your secret weapon to outwit the market's emotional roller coaster. Therefore, let’s venture into the inner workings of the Fear and Greed Index, its significance, and how you can wield it to your advantage.

Understanding the Fear and Greed Index

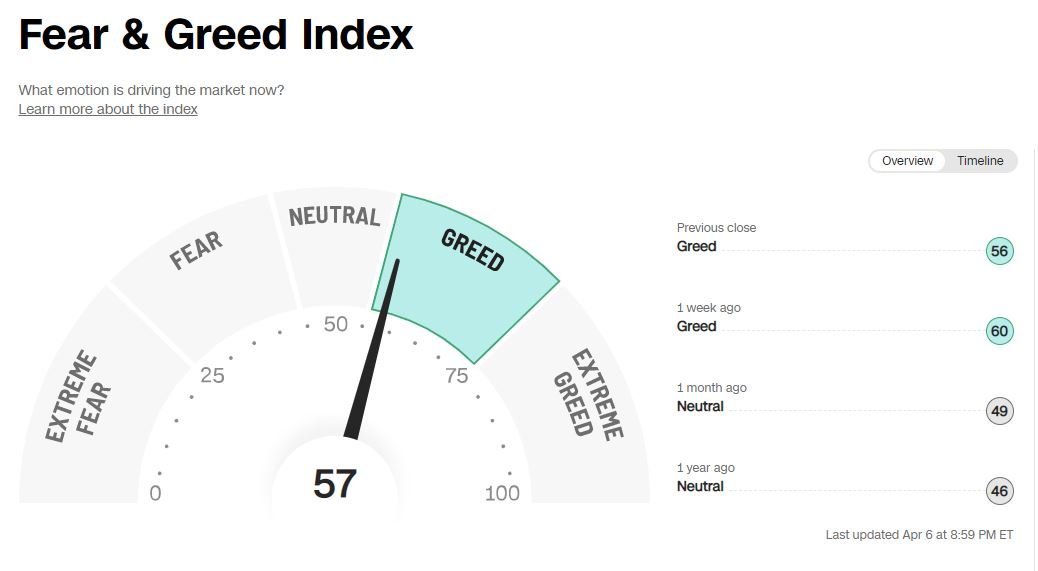

The Fear and Greed Index is a marvelous concoction that combines seven potent ingredients to unveil the market's prevailing sentiment. Operating on a scale of 0 to 100, the index conveys the intensity of fear or greed at play, with 0 denoting extreme fear and 100 signifying extreme greed. Updated daily, this trusty compass guides investors by showcasing data trends over the past three months, one year, and three years.

The components of the index include:

Stock Price Momentum: This measures the S&P 500 Index's performance relative to a 125-day moving average, reflecting market momentum.

Stock Price Strength: The number of stocks reaching 52-week highs relative to those reaching 52-week lows on the New York Stock Exchange (NYSE) is evaluated to gauge market breadth.

Stock Price Breadth: The trading volume of advancing stocks relative to declining stocks on the NYSE is assessed to determine market participation.

Put and Call Options: The ratio of put options to call options traded on the Chicago Board Options Exchange (CBOE) reflects investors' expectations of future market movements.

Market Volatility: The CBOE Volatility Index (VIX), often referred to as the "fear index," measures the market's expectation of volatility over the next 30 days.

Junk Bond Demand: The yield spread between investment-grade bonds and junk bonds reflects investors' willingness to take on riskier assets.

Safe Haven Demand: The difference in returns between stocks and safe-haven assets like U.S. Treasury bonds highlights investors' preference for safety or growth.

The index's masterminds weave these threads together, attributing a score to each component before blending them to produce the mesmerizing Fear and Greed Index value.

Here’s what it looks like on CNN’s website.

Why the Fear and Greed Index Deserves Your Undivided Attention

The Fear and Greed Index is a fascinating guide for investors, offering:

Sentiment Analysis: As the oracle of market sentiment, the index enlightens investors about the market's emotional state, empowering them to make well-informed decisions.

Contrarian Indicator: Like a wise mentor, the index teaches investors the art of contrarian investing. Extreme fear or greed can foreshadow potential market reversals, signaling investors to seize opportunities or brace for a downturn.

Risk Management: By revealing the market's emotional undercurrents, the index helps investors navigate treacherous waters and manage their risk exposure by adjusting their portfolios accordingly.

A Real-Life Example:

Here’s a real-life example of how the Fear and Greed Index can help guide you. On March 15, 2023, the index went into Extreme Fear territory (with a reading of 22, see the chart below), signaling a potential buying opportunity (queue the quote: “Be greedy when others are fearful.”)

And then perhaps not by coincidence, the market ended up being at a swing low around that time, which was a good time to buy. See the highlighted part in the S&P 500 (SPY) chart below. The chart is from TrendSpider.

There’s Also a Crypto Fear and Greed Index

There is also a Crypto Fear and Greed Index available at alternative.me. It operates on the same principle as the traditional Fear and Greed Index, reflecting the prevailing sentiment in the cryptocurrency market. The index ranges from 0 (extreme fear) to 100 (extreme greed), with daily updates to keep investors well-informed. A key distinction between the traditional index and its crypto sibling is the latter's focus on the digital currency landscape, primarily on Bitcoin, the flagship cryptocurrency.

Conclusion

The Fear and Greed Index is an enigmatic yet invaluable tool that can unlock the door to better investment decisions. By understanding the index's inner workings and embracing its guidance, investors can navigate the thrilling roller coaster of the financial markets with confidence. Like a trusted friend or an investor’s compass, the Fear and Greed Index can illuminate the path to success, helping investors harness the power of market sentiment and turn it to their advantage. So, buckle up and let this enigmatic index be your guide on the exhilarating journey through the world of investing.

Gary, the Greedy Investor

If you’re into poetry and storytelling, check out this post about Gary, the Greedy Investor from our affiliate, Stock Market Poetry. Will greed make Gary lose all of his money? Maybe, if you’re a greedy investor yourself, you can relate to it.

Tools to Help You Beat the Market

TrendSpider provides advanced charting software, automated technical analysis, advanced price alerts, backtesting, the ability to create trading bots and trading strategies, insider trading info, advanced stock screeners, and more.

Get 25% off TrendSpider plans by clicking here and using the coupon code SBR25 when signing up.

Simply Wall St helps retail investors build successful stock portfolios with their platform, where you can research and analyze the companies you love. Access highly-useful stock screeners and easily analyze a company’s balance sheet health, insider trades, analyst forecasts, valuation metrics, and more.

Simply Wall St is free to use forever, but if you want a 14-day free trial and a 30% discount, then you can sign up through our link by clicking here.