Why Undervalued Stocks Keep Failing You

If you have spent years buying stocks that looked cheap and still lagged the market, it probably was not bad luck. It was a misunderstanding of what actually moves stock prices.

I had years of underwhelming performance because I bought things that were traditionally undervalued, whether that was through a DCF valuation or some other valuation method. And these were stocks that look “obviously” undervalued.

I even learned to read financial statements, focus on strong balance sheets, solid margins, and seemingly reasonable multiples. Truly strong businesses. On paper, these names look like obvious winners. You just think, “Okay. I bought an undervalued stock. Now I just need to wait for the market to realize it and send shares higher.”

In reality, a lot of them go nowhere or quietly bleed lower while capital flows to other parts of the market. The gap between “good business” and “good stock” becomes painfully clear only in hindsight.

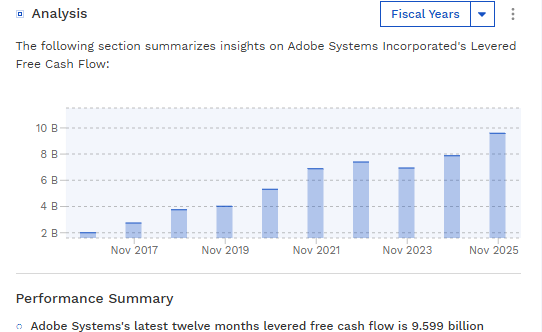

Adobe (ADBE) stock is a good recent example. It’s definitely “cheap” based on traditional metrics. It’s a software company with a 12-13x forward P/E last time I checked. Many platforms will tell you it’s undervalued, and honestly, it probably is. But that hasn’t stopped the stock from being a big underperformer while the market is near all-time highs. I mean, think about it, the stock is undervalued because it’s underperforming. Your “Buy” decision right now isn’t just going to change the trend of underperformance overnight. If you buy this type of stock, just know what you’re getting yourself into. See the ADBE chart below.

Stock prices move when expectations about the future change, not when something looks inexpensive in isolation. Valuation is part of the story, but it is rarely the main character.

The Difference Between Value And A Catalyst

Most so‑called undervalued stocks don’t underperform because the underlying business is broken. Again, using ADBE as an example, that business isn’t broken. It’s still growing and has record free cash flow of nearly $10 billion over the past 12 months.

These types of stocks underperform because nothing forces the market to re‑evaluate its expectations. A stock can sit at a low multiple for years if growth is slowing, sentiment is damaged, or investor attention has shifted elsewhere. In that environment, the low valuation is not a tell that the market is wrong. It is often an acknowledgement that the best part of the story is already behind the company.

Many investors get stuck because they treat time itself as the catalyst. They assume that if a stock is cheap enough and the business is not deteriorating in a dramatic way, the market will “eventually” close the gap. Sometimes that happens. I won’t deny it, but often it does not, or it takes a long time to happen, while the market leaders keep leading.

And then if your undervalued stock eventually ends up bouncing, you may sell it when it’s near fair value, and then you have to look for another undervalued stock to buy, which might be another stock that takes years of waiting for the market to “maybe” realize its potential.

Without a real change in the outlook or the narrative, the market has no urgency to reprice the stock. The multiple that looks absurd in a backtest can feel perfectly normal in the context of slowing growth and fading enthusiasm.

This is how value traps form. The numbers are not terrible. The stock simply loses its reason to move in a positive direction. The investor sees a discount to the past. The market is already focused on a less exciting future.

And to be clear, I’m not necessarily saying you’ll underperform the market if you buy ADBE right now, but what I am saying is it may be a better idea to buy it if you truly think there’s a catalyst to send it higher (there may or may not be…I haven’t analyzed it in a while). Not just because it’s cheap. Just my opinion though.

A Value Trap I Fell Into: InMode Stock

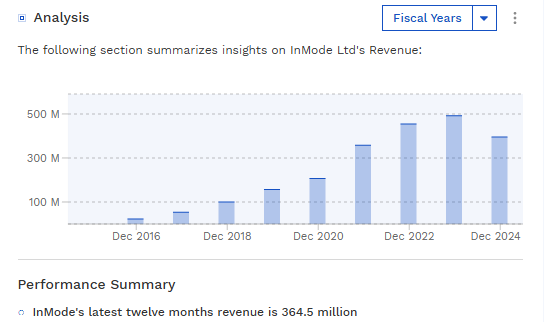

InMode is a useful example of how this plays out in real time. For several years, the company looked like a dream setup for fundamentally minded investors. It sold medical aesthetic devices, enjoyed high margins, reported strong returns on capital, had no debt, and held a huge cash position. Revenue grew very quickly in the earlier years (during COVID), and for a time the market rewarded that growth with a premium multiple, as seen in the stock’s sharp run‑up in its early public life.

Then, things changed…

The picture changed gradually, not overnight. After the pandemic period, which had helped pull forward a lot of demand across elective procedures and equipment, InMode’s revenue growth began to decelerate. Annual revenue growth fell from very high rates to more modest levels and then eventually slipped into outright decline by 2024. At the same time, competitive pressures and a maturing product cycle started to weigh on sentiment.

Here’s the thing though. The stock seemed crazy undervalued. On September 6, 2024, I published an article on Seeking Alpha titled “InMode Stock: An Inverse Bubble Caused By Short-Term Trouble” and I even gave it a Strong Buy rating. The stock was around $15.65 at the time. Now, it’s at around $14. I put too much emphasis on its low valuation, mentioning its 8.35x forward P/E ratio at the time. To be fair to myself, I didn’t mention that there was imminent upside potential with INMD, I just mentioned that I couldn’t picture the stock going much lower (for reasons I won’t get into). That prediction turned out to be right, but it doesn’t matter. The market ripped higher and INMD did nothing.

Eventually, I learned my lesson and published an article on April 29, 2025 titled “InMode Q1 Earnings: Short-Term Catalysts Have Vanished (Rating Downgrade)”

I gave the stock a “Hold” rating by then, which was a big deal for me since this was a stock I held since 2020 for the most part, and I had previously given it a Strong Buy rating. This came after years of disappointment.

In that article, I wrote “The company has high margins, lots of cash, and operates in a growing market, but short-term catalysts are lacking” and “Long-term potential remains, but I don’t expect a sustainable rally in INMD stock without meaningful catalysts; a short-term bounce might occur due to oversold conditions.”

The stock has literally chopped around and done nothing since then. Good thing I got out of that stock. Meanwhile, the valuation has been cheap this entire time. This company has no debt, a cash pile of $532 million, a market cap near $900 million and lots of free cash flow. Plus, high margins. Classic value. But nope. Not enough.

The story that had once been framed as a high growth medical aesthetics winner quietly shifted into something closer to a mature device company with slowing momentum.

Key point: The low valuation on InMode in recent years was not a clear signal that the stock was mispriced. It was a reflection of the changed expectations. Revenue was no longer growing rapidly. Guidance did not point to a credible path back to high growth. The market did not see a near term catalyst that would change the trajectory. In that situation, a low multiple can simply represent a fair price for a slower, more uncertain future. To an investor anchored on historical growth and peak margins, the stock looked obviously cheap relative to its past. To the market, it looked appropriately valued relative to its new future.

If you like what you’re reading so far, please consider subscribing to my substack to support my work!

What Actually Moves Stock Prices

If valuation alone is not enough, what actually moves stocks in a durable way? In practice, prices move when the market has to adjust its expectations more quickly than it anticipated. That adjustment can be positive or negative, but the mechanism is the same. A large group of investors realizes that their mental model of a company’s future is wrong or incomplete, and they reposition.

Often, that repositioning is triggered by a clear change in the growth profile. Revenue, users, orders, or bookings inflect after a period of skepticism, and the market realizes it has been too pessimistic. Sometimes the trigger is a strategic shift, such as a new product line, a transformative acquisition, a credible cost reset, or a capital allocation decision that changes how much cash will reach shareholders.

In other cases, the personality of the story changes during an earnings season, when guidance and management commentary force investors to rethink what kind of business they are actually dealing with. Company calls and guidance revisions for InMode are a good example of how softening expectations, without an offsetting new growth angle, can anchor a stock in a lower valuation range.

Valuation still has its place, but more as a boundary and a magnifier than as a trigger. An expensive stock with strengthening expectations can remain expensive for much longer than feels rational to investors who focus only on current earnings. A cheap stock with deteriorating or stagnant expectations can remain cheap while capital quietly migrates to other areas of the market. This helps explain why stocks that many label as “hype” or “speculative” can dramatically outperform traditional value names during certain cycles.

It’s not that fundamentals are irrelevant. It is that the market in those periods rewards visible runway, optionality, and improving narratives more than tidy backward looking metrics.

The Chart Tells You More Than You Think

Lots of investors write-off chart analysis, considering it to be a tool for traders only. But here’s the thing. The chart tells you whether the market cares or not.

You think a company is undervalued and turning around, but the stock is consistently trending lower? That means the market doesn’t care yet. You can be right about the company, but the downtrend can still continue.

Put simply, I often wait for the market to notice, wait for signs of bottoming in the chart (or wait for signs of an uptrend), and then hop in. It seems simple…but people don’t follow this rule and it costs them.

Context, Timing, And What Investor’s Compass Will Focus On

One more mistake is worth naming directly. Many investors analyze stocks as if they exist in a vacuum, independent of the broader environment. In reality, different market regimes reward different traits. There are periods when cash flow stability, dividends, and defensive positioning are prized and command premiums. There are other periods when the market cares far more about growth, optionality, and exposure to specific themes.

A strategy that worked beautifully in one cycle can fail outright in another because the underlying reward structure changed while the playbook stayed the same. This is visible if you compare the performance of classic value factors and high duration growth exposures across different stretches of the last decade.

Investor’s Compass is an attempt to build around these lessons instead of pretending they don’t exist. The focus is not just on finding solid businesses, but on understanding the expectations already baked into the price, the potential catalysts that could change those expectations, and the market context that will determine whether those catalysts are rewarded.

If this is something that interests you, or if this article was of value to you, please consider subscribing. It would mean a lot! This was originally posted on my Substack. The original can be found here.