This Earnings Week Will Help Decide Whether The AI Trade Still Works

This is going to be a big week in the market, with an FOMC decision on Wednesday and lots of high-profile earnings reports. But it’s not just that there are lot of big names reporting. Many of them sit at different points along the same trade, especially around AI, capex, and growth expectations.

Some companies reporting earnings this week are Microsoft, Meta, Tesla, ASML, Lam Research, Celestica (all on Wednesday), Apple (Thursday), and KLA. Add in names like FICO, UnitedHealth, American Express, Starbucks, and MSCI, and you’re covering tech demand, infrastructure, consumers, and financial conditions all in one week.

This article is going to be more of a brief overview, but I’ll have more in-depth articles coming soon, so stay tuned. Without further ado, let’s get started.

Eyes On AI Demand Trends And Disciplined Spending

For Microsoft and Meta, everyone already assumes AI demand is strong. That’s not the debate. The real question is whether the amount of money being spent to support that demand is showing up in margins and cash flow.

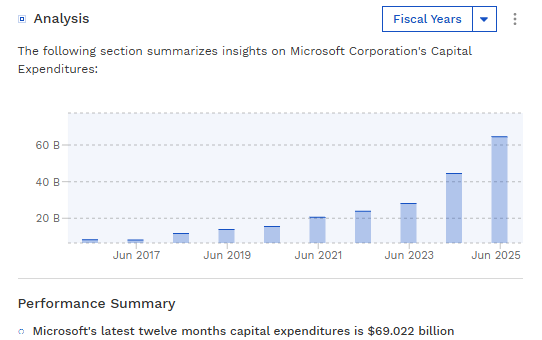

Microsoft’s Azure growth matters, but what also matters is whether margins hold while CapEx stays elevated. Microsoft’s CapEx has increased quickly in the last few years. See below.

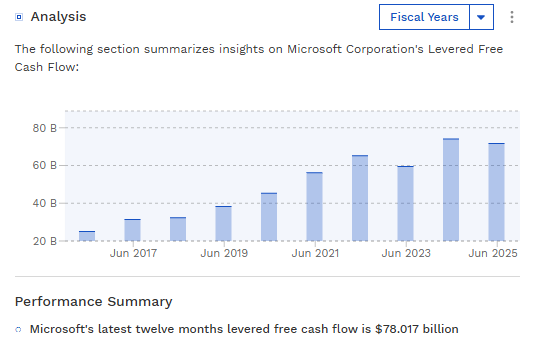

Meanwhile, free cash flow hasn’t grown nearly as quickly.

Anyway, if margins do hold steady, it reinforces the idea that AI workloads are scaling efficiently. If margins slip or guidance gets cautious, the market could eventually start to price in execution risk, not just growth.

Meta is similar but riskier. The ad business is growing, but AI spending is massive, with TTM CapEx at $62.7 billion compared to $30.42B in TTM CapEx at this time last year. Investors want to know if engagement and monetization gains are enough to justify that spending, or if returns are getting pushed further out.

Apple is different. AI here is more about whether it can drive a new device upgrade cycle. If management frames AI as a real reason people will replace phones and hardware, expectations rise quickly. If it’s framed as incremental, Apple trades more like a defensive again.

Semiconductors Show Whether Growth Can Sustain Itself

ASML, Lam Research, and KLA matter this week because they sit at the point where AI demand turns into real spending. At this stage, the question isn’t whether demand exists. It’s whether the current level of investment can continue, expand, and translate into sustained growth across the stack.

For ASML (which makes machines to create advanced chips), what matters is visibility. Order trends, backlog stability, and guidance around future tool demand tell you whether customers are committing to multi-year buildouts or just reacting tactically. As long as spending plans remain intact, concentration among a small group of buyers isn’t an issue. What would matter is a change in commitment.

Lam Research (which makes tools that etch and deposit materials to build chips) and KLA (it makes inspection and metrology tools to detect defects in chips) add another layer by showing how costly that growth is to support.

Revenue growth alongside stable or improving margins suggests customers are absorbing higher process complexity without pushing back on pricing. If margins come under pressure, it doesn’t negate demand, but it does suggest that the path to growth may be more capital-intensive than expected.

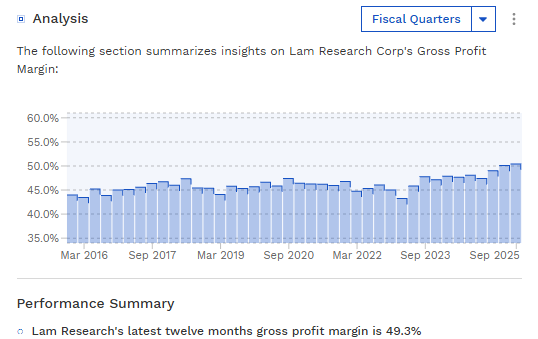

LRCX’s gross profit margin has been trending up nicely in recent years.

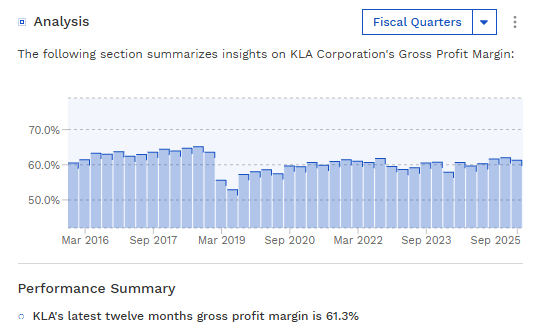

KLA Corp’s gross profit margin has been relatively stable, which is also fine.

Taken together, these companies help answer a simple question: can AI-driven growth continue at scale without eroding economics? That’s what ultimately determines how far the trade can run.

I’ll Be Paying More Attention To Celestica

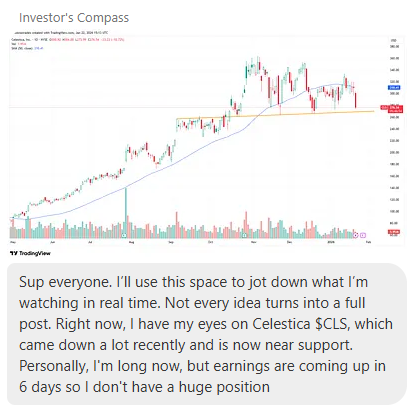

Celestica is actually the one I’ll be paying attention to the most because I have a position in it, as I mentioned four days ago in the subscriber chat on my Substack (see below). I like the chart setup right now, and it has had some great earnings momentum recently.

Anyway, knowing Celestica’s results is useful because the company sits closer to the physical side of the AI buildout. Celestica designs and builds hardware systems for data centers and AI infrastructure.

Analysts expect a whopping 58.8% YoY EPS growth rate for Q4-2025 and a 37% YoY revenue growth rate. But remember, guidance is what matters. And price action. I wouldn’t want to see it break its uptrend.

I’ll write an analysis on Celestica stock soon. Maybe a pre-earnings article or a post-earnings article, or both.

Tesla and Consumer Names Test a Different Risk

Tesla’s earnings are less about numbers and more about credibility. The market already knows its margins are weak. What it’s watching is whether investors still believe AI and autonomy will materially change earnings power in a reasonable timeframe.

Consumer-facing names like American Express, Visa, and Mastercard matter because they tell you whether the broader economy is holding up while capital keeps flowing into tech.

If credit card spending holds steady, Wall Street says "tech boom, healthy consumers = perfect."

What To Make Of All This Info

I’m not obsessively watching over every earnings report, but I am watching for patterns.

Are companies talking confidently about demand, or hedging guidance? Are margins holding up where they should? Is spending starting to look less disciplined? Are expectations being reset, or reinforced?

More importantly, what is the overall price trend for these stocks after earnings? If this earnings season shows a lot of optimism, with big price swings upward on good news, I’ll be more confident in following the upward trend in the market, buying dips.

Strong numbers with weak reactions would be a warning. Average numbers with strong reactions tell you positioning was too conservative.

Sometimes the most valuable outcome from a week like this is not a trade, but clarity.

This post was originally written on substack for free. If you like my work, please consider subscribing to me there! Here’s the original post.