My Top 6 Stocks I'm Watching Now

Hey everyone, I’m watching a lot of stocks, but some more closely than others. Here are some that stick out to me because of their catalysts and upside potential.

#1 in particular is one that I have a position in right now. Let’s get started.

1. Lemonade (LMND)

Great chart momentum overall and it rallied last week on news that it plans to cut insurance rates by up to 50% for Tesla drivers when Tesla’s Full Self-Driving (FSD) software is actively steering, citing data that shows the system significantly reduces accidents. LMND is using Tesla vehicle telemetry data to distinguish between miles driven by FSD and by humans, allowing more precise, pay-per-mile pricing.

LMND Weekly Timeframe

The news caused a 13% gain in one day on January 22, and the stock has since pulled back, filled the gap, and looks like it’s now heading for the next leg higher. It’s got a catalyst and momentum. Only issue is the $100 resistance level, which I’ll be keeping an eye on. People love big round numbers as resistance areas.

This is my favorite immediate setup. I took a position around $91.80 and will likely add more if it dips tomorrow, but I won’t hold through if it starts breaking the support around $85.75 (Monday’s low).

LMND Daily Timeframe

2. Zscaler (ZS)

Generally an uptrending stock with strong revenue and EPS growth. It has pulled back quite a bit recently and is showing signs of life now near trendline support. Historically, buying the large downswings has worked with ZS, but I wouldn’t just try to time the bottom. Wait for more signs of bottoming. Earnings coming up on February 19. Expected YoY revenue growth for the earnings report: 23.3%. Pretty good.

3. Texas Pacific Land Corp (TPL)

Extremely profitable oil company that makes money from royalties. And when I say extremely profitable, I mean its gross margin is 94.1%. It’s also getting into AI data centers. Yup, that’s right.

It’s starting to emerge out of a downtrend now, potentially on its way to continue an insane long-term uptrend.

4. Applovin (APP)

Huge growth stock. It’s an AI-powered advertising software platform that helps businesses find and monetize users. Now, it’s sitting near support, and a bounce is possible. Although for me, it’s too early to make any moves. Earnings coming up February 11.

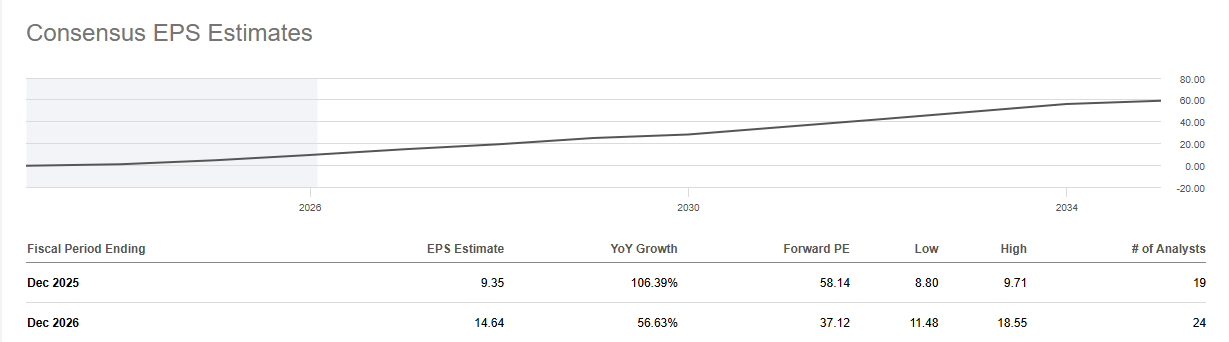

But this is one of those stocks that works in this AI-driven market. Investors love high-growth names, and APP is expected to see 56.6% EPS growth this year.

Applovin EPS Estimates

5. Nvidia (NVDA)

We all know what’s driving Nvidia higher. AI is taking over the world. I don’t need to get into the catalysts right now. Betting against NVDA has generally been a losing game. Now, it’s emerging out of a consolidation chart pattern. I think that if it decisively closes above $193.65, the uptrend will continue. I’m keeping a close eye on this one.

6. Celestica (CLS)

I mentioned this one in previous posts. I had a position from ~$290 and sold some around $320, and then a bit more around $330. I’m now left with a tiny position on it that I held into earnings. Earnings were great, beating expectations, with management raising guidance, but it wasn’t enough. The stock actually rose to around $358 in after-hours but then fell, turning red.

Currently, it’s at $328.50 in after-hours trading. I don’t like the fact that even on good earnings, it got stuffed near resistance and is now down. I’m not looking to buy here unless the stock starts bouncing again near support in the high $200s or if it breaks out decisively into new highs. Right now, it’s in a middle-range that isn’t super attractive. It’s a wait-and-see stock.

Thanks for reading! If you liked this article and found it valuable, please consider subscribing! It will help me out a lot. Best of luck to all of you! And don’t forget to check out my last post, which explains how buying overbought stocks isn’t always as bad as it seems!

This article was originally written on my Substack. Here’s the link to the original.