Silver Crashed 35% in a Day. Why I'm Not Buying The Dip

Silver was down around 35% at one point today, easily losing well over $2 trillion worth of value in a single day. Last week, I wrote about silver breaking through $100 per ounce and what to do next, even if you thought it was overextended.

Silver then topped out a few days later at over $121 per ounce before crashing.

Moves like this tend to shock investors, but in reality, you have to expect these kinds of moves. They’re textbook. Don’t blame it on market manipulation either if you got caught with your pants down!

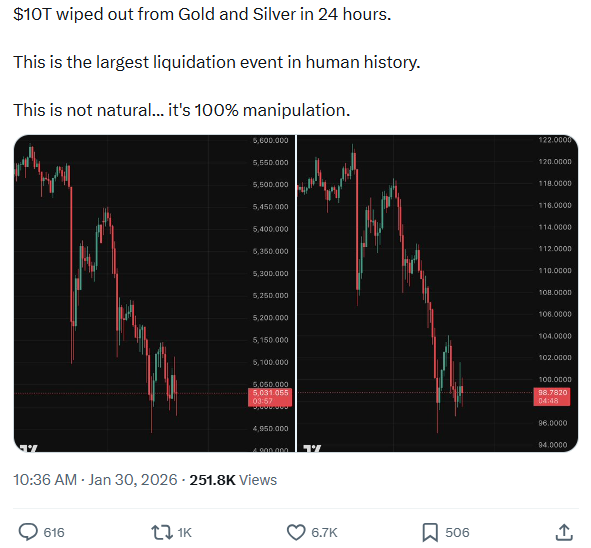

I saw this post on X today blaming manipulation. Here’s the post below:

Come on brah, did you expect silver to go up 10% every day for the rest of your life with no consequences? When everyone is buying for FOMO reasons and the price eventually drops a bit, don’t you realize that everyone who FOMO bought will sell just as quickly?

And why is manipulation blamed only when the price goes down? Did you know manipulation can happen on the way up too?

I get the frustration, but people just want to blame others or “the market” when they get proven wrong. Stop fighting the market!

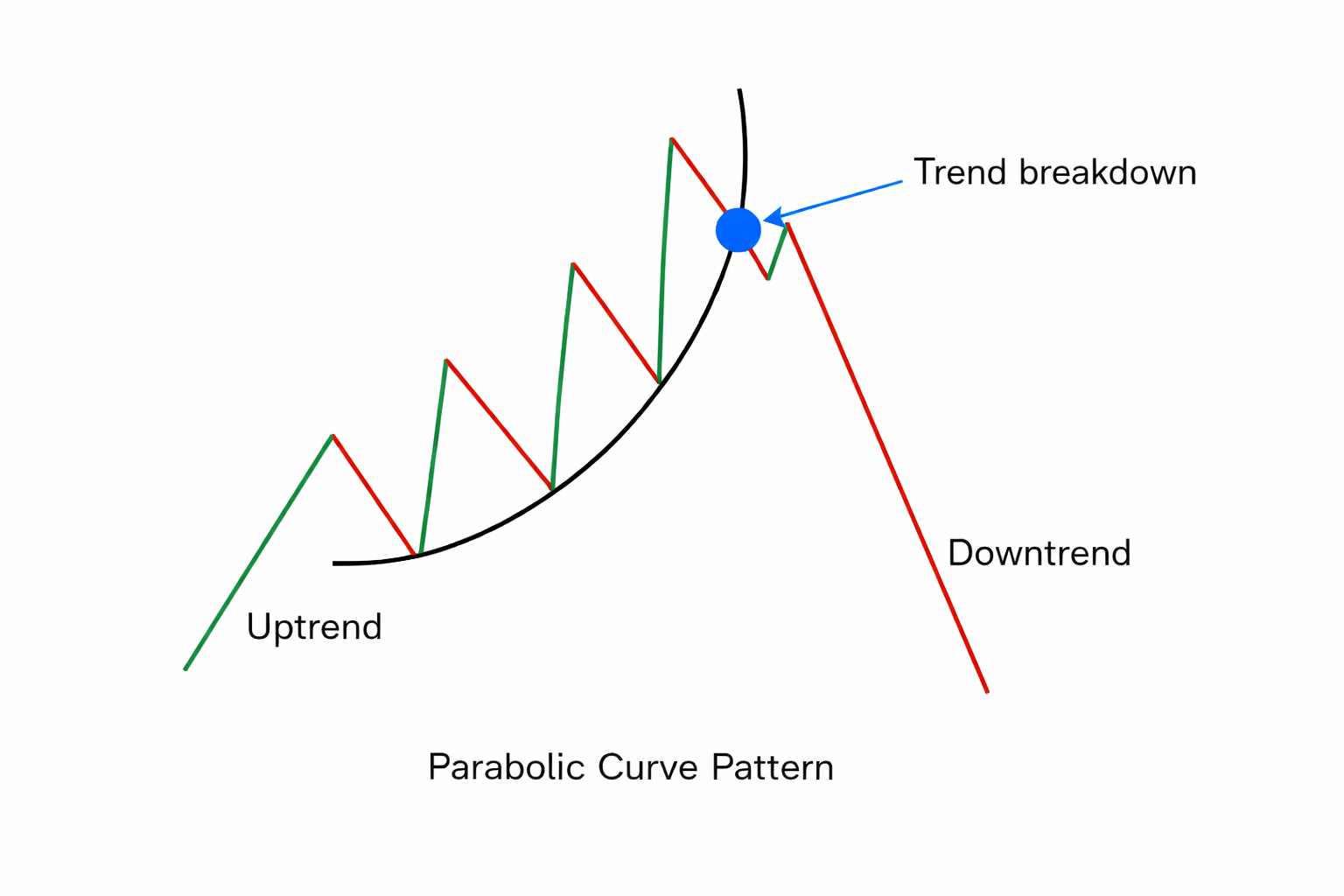

This was a textbook outcome for an asset that had gone parabolic in a very short period of time.

Those types of moves are rarely sustainable because they attract short-term momentum traders, leverage, and speculation far more than long-term capital. At that point, anything can cause a panic crash.

In my previous article, I mentioned that you could just follow the 9-day exponential moving average and buy dips until that trend breaks, since silver was hovering above that line. With the 9 EMA trend now completely broken, this is not a dip buy I’m interested in.

It’s not as though silver can’t bounce more from here. Things can bounce when they fall hard. But what I mean is that it’s likely difficult for silver to repeat that same momentum it had for the past few months.

This is not a healthy pullback. This is a flash crash where the market is saying, “We’ve had enough for now.”

From a catalyst perspective, the timing of the sell-off also coincided with President Trump’s nomination of Kevin Warsh as the next Federal Reserve chair. This shifted market expectations around interest rates, inflation tolerance, and the U.S. dollar. Warsh is widely viewed as more hawkish (meaning tighter monetary policy, higher interest rates, etc.) than many investors had anticipated, which isn’t great for precious metals.

It’s important to be clear here: the Warsh news did not cause silver to fall from $120. Silver fell because it was overextended, leveraged, and vulnerable. The Fed headline simply accelerated what was already likely to happen. In stretched markets, macro surprises act as catalysts that compress timeframes. What might have taken weeks to unwind instead happened in a single session.

So what should investors do now? First, avoid the temptation to treat this as a buying opportunity just because silver is “down a lot.” From my experience, sharp corrections after parabolic moves don’t typically lead to new highs right away. The market needs time to reset volatility, shake out weak hands, and rebuild structure. That process can a while.

Second, this move reinforces the point I made last week about strategy. When implied volatility is elevated and price is extended, buying call options tends to be a losing proposition. Selling premium or waiting patiently for better setups offers a far more favorable risk-reward profile. That framework hasn’t changed, even if the price has.

Finally, none of this automatically invalidates the longer-term silver thesis. Structural demand, electrification, and industrial usage still matter. But markets don’t move in straight lines, and the “easy money” part of this rally is clearly behind us for now. From here, discipline matters more than conviction.

Silver went from being ignored to being crowded very quickly. This correction is the market reminding investors that even the strongest trends need pauses. The next opportunity will come, but only after the excess has fully worked itself out.

Thanks for reading! If you liked this article and found it valuable, please consider subscribing to my Substack! It will help me out a lot, as articles like this take lots of time to write. Best of luck to all of you.

This article was originally written on my newsletter here.