Top 9 Stocks To Watch Now

Hey everyone, I’m watching a lot of stocks as usual, but some more closely than others. Here are some that stick out to me because of their catalysts, technicals, and upside potential.

#1. Nu Holdings (NU)

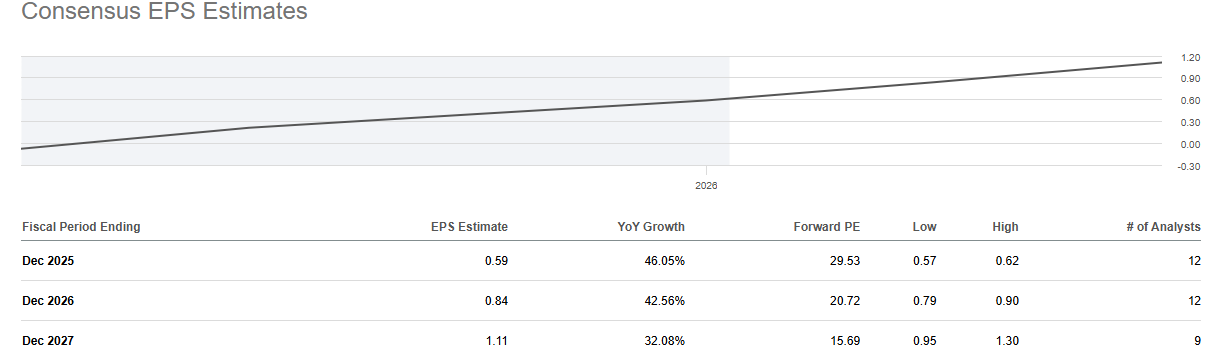

Leading digital bank in Brazil and other countries, quickly growing its earnings while trading at a reasonable valuation. EPS growth of 42.6% expected for 2026. Forward P/E 20.7x.

Importantly, the stock is trending higher, and it looks like it’s heading for $20, bouncing off that diagonal support. I think the trend remains strong as long as the stock stays above $16.50 for now (the latest swing low). But keep in mind that it’ll report earnings on February 25.

#2: Microsoft (MSFT)

MSFT got caught in the SaaSpocalypse software stock sell-off, but the long-term fundamentals are still intact. Microsoft is an AI leader, with more double-digit growth ahead.

Chart-wise, it looks like an interesting place to start a position. There’s clear trendline support. If that breaks, the next support is the 200-week moving average (the red line).

Microsoft hasn’t really been under that 200-week moving average since 2011, so a break here would be rare, reinforcing the buy-the-dip thesis. There’s no confirmation of a bounce though so I wouldn’t bet the farm on it.

#3. Celestica (CLS)

This one avoided the heavy sell-offs that tech stocks saw last week. Relatively strong, which I like. It’s still holding up above that trendline.

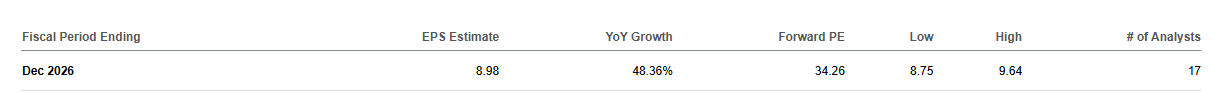

If it breaks out, it can be a huge move, considering that the market loves its growth potential. 48.4% EPS growth expected for this year (see below).

Heavy capex spending from big tech directly benefits Celestica, because hyperscalers ramp demand for AI servers, networking gear, and custom hardware that Celestica designs, builds, and supplies.

#4. Constellation Software (CSU.TO)(CNSWF)

Absolute bloodbath in Constellation Software, which was historically been one of Canada’s best companies. If you don’t know what this company does, it’s basically a company that acquires software companies. That’s its business model.

This chart is broken at the moment, so it’s rare for me to be seriously considering buying into a broken chart, but I think CSU stock is an exception for a few reasons.

First, the business itself isn’t broken. Still expected to grow earnings in the double-digits. Also, the sell-off is largely due to AI panic, even though I don’t think AI tools like Claude are going to meaningfully affect Constellation Software because CSU’s businesses sell mission-critical, highly verticalized software where value comes from deep workflow integration, regulatory nuance, and switching costs, not generic text or code generation.

As of now, I don’t think this is a value trap. It may very well be a good long-term buy right now as long as it continues to keep growing the way it always has. I’m thinking of also writing a longer-form article on CSU sometime soon. Stay tuned!

#5. Albemarle (ALB)

Lithium producer Albemarle has been on a tear in the past few months but came down in recent sessions, and it could be a dip buy.

The last three weekly candles remind me of the three weekly candles from November. I highlighted them on the chart. Meanwhile, the 9-week EMA (blue line) still hasn’t been broken, so the uptrend is intact. I wouldn’t be long if it breaks below that though.

#6. Applovin (APP)

In last week’s watchlist on Substack, I had APP on it, and I wrote:

Huge growth stock. It’s an AI-powered advertising software platform that helps businesses find and monetize users. Now, it’s sitting near support, and a bounce is possible. Although for me, it’s too early to make any moves. Earnings coming up February 11.

I’m still watching the stock, which has fallen considerably since then. Haven’t bought shares, but it bounced off the diagonal support line. If it pushes past Wednesday’s high of $410, it can go try and fill that gap to ~$450, but there may not be enough time to even let that play out because of the upcoming earnings report.

Most likely, I’ll wait until after earnings and see if the stock drops but holds the diagonal support area. If so, it could be a buy.

#7. Texas Pacific Land Corp (TPL)

Another one from last week’s watchlist.

I previously wrote:

Extremely profitable oil company that makes money from royalties. And when I say extremely profitable, I mean its gross margin is 94.1%. It’s also getting into AI data centers. Yup, that’s right.

It’s starting to emerge out of a downtrend now, potentially on its way to continue an insane long-term uptrend.

It looks even stronger than it did last week, with a strong close and no damage from the tech sell-off. I’m looking for a dip to the $340-350 range. Heavy resistance starting around $470. Support around $327 (last week’s low) and $268.

#8. Viking Holdings (VIK)

If you want to hear my FULL thoughts about this high-growth cruise line stock, go read my Viking article titled “This “Cruise Line Stock” Is Growing Faster Than Many Tech Stocks.” I don’t think you’ll be disappointed! Uptrend intact, but I don’t wanna say too much here. Go read the article ;)

#9. BJ’s Wholesale Club (BJ)

Retailer BJ’s Wholesale is setting up for its next leg higher, can we agree on that? If the market volatility is getting to you, this is a great stock to consider, with its 0.37 beta and steady fundamentals. This is not the type of stock that gets caught in a panic, so it can provide diversification in that sense. A dip to the $97 level is worth watching for.

Thanks for reading! If you liked this article and found it valuable, please consider subscribing! It will help me out a lot, as articles like this take lots of time to write.

More paid stock analysis articles coming soon (like Nu Holdings), so don’t miss out. Best of luck to all of you, and remember, this is just my opinion, not financial advice!

And don’t forget to check out the rest of my recent articles!

Viking Holdings $VIK: This “Cruise Line Stock” Is Growing Faster Than Many Tech Stocks

Is Bitcoin Still Heading to $0 Despite Today’s Bounce?

How To Survive The SaaSpocalypse

Start Using TrendSpider Today

I used TrendSpider for the charts in this post. It’s a top-tier charting platform that also lets you test rule-based strategies across long timeframes without a ton of manual work. If you’re curious, you can check it out. They’re offering a 32% discount through this link. I wouldn’t mention it if it sucked.